Navy Federal Business Loan Interest Rate

Rates for 3-Year Variable Rate Certificates adjust each year on the anniversary date of the purchase. Non-Owner Occupied 1- 4 Family Residential Properties.

Navy Federal Business Loan Review 2021 Lendingtree

Navy Federal Business Loan Review 2021 Lendingtree

None if performed at a Navy Federal branch or ATM.

Navy federal business loan interest rate. Favorable terms Loan Types. Up to 5 years. Assuming a 10000 loan amount a 10-year term and a 316 APR you would make 54 48 months in school 6-month grace period monthly payments of 25 while enrolled in school followed by 120 monthly payments of 9809 to repay this loan.

Late Model Used Vehicles. What are the Navy Federal Credit Union Money Market Savings Account rates. What are the benefits of Navy Federal Credit Union auto loans.

Rates start at 179 for boat loans with terms up to 180 months. Loans run from 250 to 50000 with terms up to 5 years. Benefits of getting a business loan from a credit union.

2020 2021 and 2022 model years with 7500-30000 miles. 3 rows Navy Federal may require you to secure your business line of credit against your receivables. If your original home loan is with Navy Federal a refinance loan is underwritten in much of the same manner as purchase loans.

Navy Federal loans rates range from 749 to 1800 APR with no origination fees. Navy Federal Credit Union offers competitive auto loan rates for military personnel veterans and their families. Visit our site for more information about car loans and member benefits.

A business checking line of credit CLOC is a credit product with a fixed rate of 179 APR. Navy Federal Credit Union Money Market Savings Account offers an APY starting at 04 and ranging up to 045 APY stands for annual percentage yield rates may change. All other vehicle start at 809 APR with terms up to 180 months.

Loan repayment depends on the repayment option elected by the borrower. Since NFCU is a federal credit union they are required to cap their interest rates at 18. However to earn interest you must keep a minimum balance of 2500.

Navy Federal personal loan interest rates range from 749 to 1800 but the longer the loan is the more expensive the APR is likely to be. Loans for a motorcycle loans start at 725 APR with terms up to 84 months. A loan amount of 5000 for 36 months has a payment range from 156 to 183 and finance charge range from 623 to 1598.

Variable-Rate Loan Payment Example. A 25 Monthly Payment Option. Payment examples do not include taxes home.

If youre an active duty or retired member of the military you can can qualify for a 05 discount on your rate. 60-65 LTV on specialty properties. Federal credit unions legally cant charge more than 18 interest on their loans and many others charge even less.

Multi-Family StructuresComplexes Containing 5 or More Units. Up to 80 loan to value LTV on most properties. Personal Loan rates range from 749 to 1800 APR.

You can expect comparable rates. CLOC repayment terms are 2 of the outstanding balance or 20 whichever is greater and the total outstanding balance will be due when it is less than 20. The APY is an annualized rate that reflects estimated dividend earnings based on the dividend rate and frequency of compounding.

Line of Credit Construction and Development Loans. If your original loan is not with. Credit unions often charge fewer origination.

Navy Federal Credit Union unsecured business loans. The Purchase Refinance and Texas Cash Out examples are based on a LTV 80 credit score 740 and include a standard origination fee. Rates are based on creditworthiness so your rate may change.

New auto loan of 20000 for 36 months at 179 APR will have a monthly payment of 572. As of 5120 rates range from 915 APR to 18 APR are based on creditworthiness and will vary with the market based on The Wall Street Journal Prime RateATM cash advance fees. Loans can last for up to 60 months except for home improvement loans which can last up to 180 months.

Minimum loan amount is 30000 for terms of 85-96 months. 2 rows A fixed-rate loan of 250000 for 15 years at 2125 interest and 2338 APR will have a. Must be a business member of Navy FCU.

Navy Federal Business Loans Our 2021 Review Finder Com

Navy Federal Business Loans Our 2021 Review Finder Com

100 Financing Mortgages Navy Federal Credit Union

100 Financing Mortgages Navy Federal Credit Union

Navy Federal Credit Union Our Low Rates Let You Drive In Style Services Ads From San Diego Unio Navy Federal Credit Union Federal Credit Union Credit Union

Navy Federal Credit Union Our Low Rates Let You Drive In Style Services Ads From San Diego Unio Navy Federal Credit Union Federal Credit Union Credit Union

Who Doesn T Want To Retire A Millionaire Navy Federal Credit Union Federal Credit Union Millionaire

Who Doesn T Want To Retire A Millionaire Navy Federal Credit Union Federal Credit Union Millionaire

Pin On Consumer Lending Forms For Credit Unions

Pin On Consumer Lending Forms For Credit Unions

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

See My New Video I Made Today How To Get Credit Karma Credit Card Limit

Smart Search Compare Home Loans Mortgage Calculators Investment Loans Interest Rates Home Mortgage Rate Home Commercial Loans Mortgage Mortgage Rates

Smart Search Compare Home Loans Mortgage Calculators Investment Loans Interest Rates Home Mortgage Rate Home Commercial Loans Mortgage Mortgage Rates

Borrowers Who Don T Think They Can Get A Mortgage But Can Florida Realtors The Borrowers Mortgage Lenders Lenders

Borrowers Who Don T Think They Can Get A Mortgage But Can Florida Realtors The Borrowers Mortgage Lenders Lenders

Seven Mind Numbing Facts About Sba Loans Sba Loans In 2020 Sba Loans Loan Mind Numbing

Seven Mind Numbing Facts About Sba Loans Sba Loans In 2020 Sba Loans Loan Mind Numbing

Navy Federal Business Loans Our 2021 Review Finder Com

Navy Federal Business Loans Our 2021 Review Finder Com

Navy Federal Go Rewards Card Review Great Option For Average Credit Navy Federal Credit Union Rewards Credit Cards Reward Card

Navy Federal Go Rewards Card Review Great Option For Average Credit Navy Federal Credit Union Rewards Credit Cards Reward Card

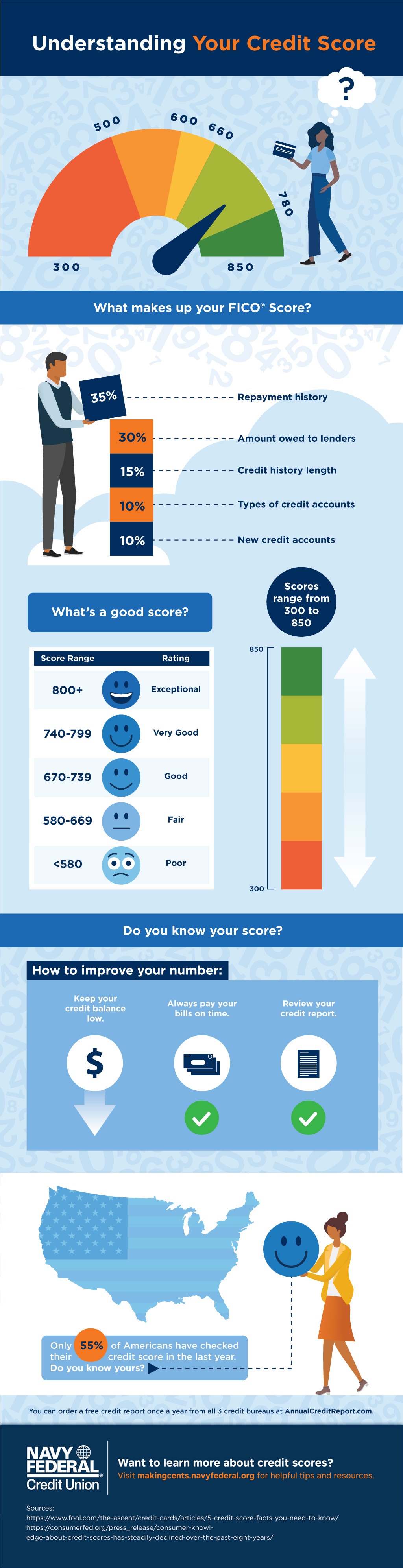

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

Everything You Need To Know About Credit Scores Makingcents Navy Federal Credit Union

/navy-federal-inv-daccae32bfff43fdb1199a75c84e848d.png) Navy Federal Credit Union Personal Loans Review 2021

Navy Federal Credit Union Personal Loans Review 2021

Navy Federal Credit Union Review Creditloan Com

Navy Federal Credit Union Review Creditloan Com

/navy-federal-credit-union_3x1-7dc9d739837f4c17a5e4b9f34f4024ef.png) Navy Federal Credit Union Personal Loans Review 2021

Navy Federal Credit Union Personal Loans Review 2021

Navy Federal Credit Union Student Loan Refinancing Review 2021 Credible

Navy Federal Credit Union Student Loan Refinancing Review 2021 Credible

Infographic The Military Home Navy Federal Credit Union Home Ownership Federal Credit Union

Infographic The Military Home Navy Federal Credit Union Home Ownership Federal Credit Union

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Consolidate Credit Card Debt Credit Score

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Consolidate Credit Card Debt Credit Score

Loan Calculator And Payment Schedule Not A Toy Nfcu Mortgage Rates Nfcu Mortgage Rates Loan Calculator Since You May Have Happened Upon This Lo

Loan Calculator And Payment Schedule Not A Toy Nfcu Mortgage Rates Nfcu Mortgage Rates Loan Calculator Since You May Have Happened Upon This Lo