How Much Does It Cost To Register A Business Name In Nj

Payment fee for registration will vary depending on the type of vehicle. If i was to open my own home studio what requirements would i need.

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

When registering the foreign business will indicate its exact formation name followed by the business name to be used in New Jersey as follows.

How much does it cost to register a business name in nj. Contact each states individual department of. You alone own the company and are responsible for its assets and liabilities. Providing whats available to me in my residential zone What do i need to do in order to register my businesses name in NJ as well as the associated costs involved.

Once you obtain an EIN complete the two filings below. Starting a Business in NJ. The minimum annual tax fee paid to the Department of Revenue is 500.

The filing fee for the annual report with the Treasury Department Revenue Division is 5000. Other business registration fees may apply. The fee is 125 for.

If you need assistance with calculating the tax please call the New Jersey Division of Taxation at 609-984-6206. Was available in New Jersey. License plates are included.

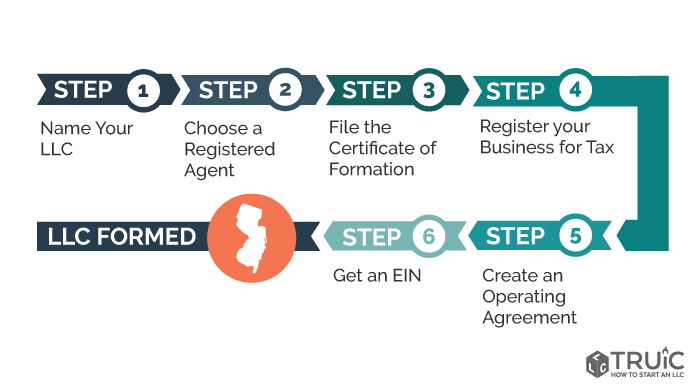

How much does it cost to register. Simple and inexpensive to create and operate. First file a Certificate of formationauthorization.

Pharmaceutical Assistance to the Aged and Disabled PAAD. To form a New Jersey LLC the New Business Entity Registration needs to be filed with the New Jersey Division of Revenue Enterprise Services along with the state filing fee of 125. The filing fee to incorporate in the State of New Jersey is 12500.

Once filed your business name will be reserved in New Jersey for 120 days. Corporations Limited Liability Companies The Registration of Alternate Name form C-150-G is available from the New Jersey Department of Treasury website. The business found that the name C B A Inc.

A sole proprietorship is the most basic type of business to establish. It will either be a photography or recording studio. Welcome to the Division of Revenue Enterprise Services Business Charter Amendment Service.

Registration discounts- PAAD SSI and Lifeline. The state filing fee for New Jersey incorporation is 12500. Doing so ensures that your business is registered under the correct tax identification number and.

Dba C B A Inc. Register for New Jersey Tax Employer Purposes. Listed below are some of the fees involved in starting your business.

Incorporated dba C B A Inc. Incorrect - ABC Inc. All for-profit and non-profit corporations LLCs LLPs and LPs must first obtain an employer identification number EIN from the IRS.

In addition the Department of the Treasury Division of Revenue requires an annual report be filed each year by your anniversary filing date. 11 anytime during the first three years of a four-year accelerated registration term. Owner reports profit or loss on his or her personal tax return.

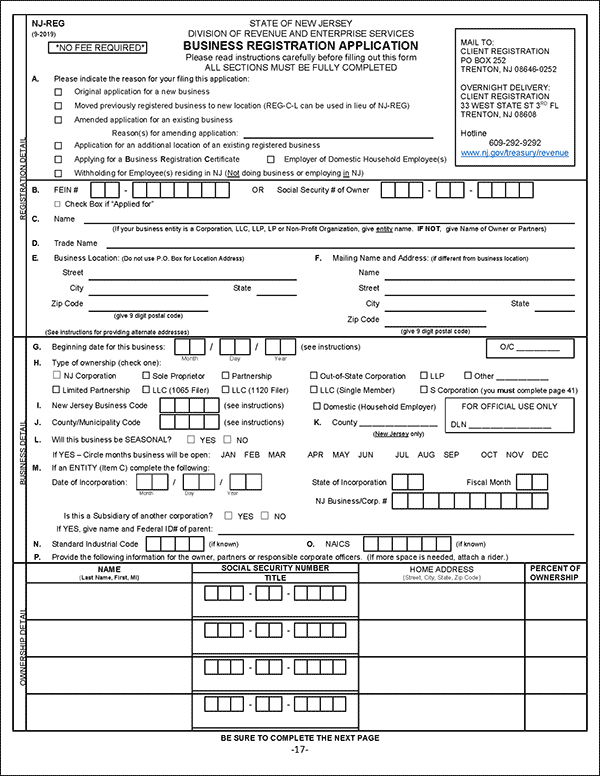

There is no fee required to file Form NJ-REG and register your business. You can renew the name reservation when it expires. Payment for the sales tax fee.

The incorrect version illustrates that the. The filing fee to register a business name in New Jersey is 50. File state documents and fees In most cases the total cost to register your business will be less than 300 but fees vary depending on your state and business structure.

You can file for a New Jersey name reservation and any number of extensions by filling out an Application for Reservation of Name and submitting it by mail to the New Jersey Division of Revenue along with the 50 filing fee. All passenger vehicles or non-commercial trucks registered to recipients of the following programs are eligible for discounted registration fees. Starting a Business in NJ If you are planning to start a business in New Jersey you must register the business with the State of New Jersey at least 15 business days prior to opening.

This service allows you to file certain New Jersey Business Charter amendments online and receive a certificate that confirms your filing has been accepted and added to the public record. You dont have to file special forms or pay fees to start your business. All businesses operating in New Jersey must file form NJ-REG either by applying online or filing by paper.

How to form an LLC in New Jersey. Also i was told that if you use your own last or first name as your business name you do not have to. The official website of the New Jersey Motor Vehicle Commission.

This will enable the State of New Jersey to send you all of the forms and information necessary for you to comply with New Jersey tax.

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Small Business Tax Spreadsheet Small Business Tax Business Tax Deductions Small Business Expenses

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

How To Start An Llc In New Jersey Legalzoom Com

How To Start An Llc In New Jersey Legalzoom Com

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Top 100 P C Insurance Companies Ranked By Net Premiums Written Propertycasualty360 Insurance Company Insurance Ranking

Top 100 P C Insurance Companies Ranked By Net Premiums Written Propertycasualty360 Insurance Company Insurance Ranking

Llc In New Jersey How To Form An Llc In New Jersey Nolo

Llc In New Jersey How To Form An Llc In New Jersey Nolo

Free Printable Power Of Attorney Form Nj 5 Taboos About Free Printable Power Of Attorney For Power Of Attorney Form Power Of Attorney Attorneys

Free Printable Power Of Attorney Form Nj 5 Taboos About Free Printable Power Of Attorney For Power Of Attorney Form Power Of Attorney Attorneys

Nj Llc How To Form An Llc In New Jersey Truic Guides

America S Sbdc New Jersey At Brookdale Community College Invites Small Business Owner Small Business Development Small Business Development Center Social Media

America S Sbdc New Jersey At Brookdale Community College Invites Small Business Owner Small Business Development Small Business Development Center Social Media