1099 Nec Business Code

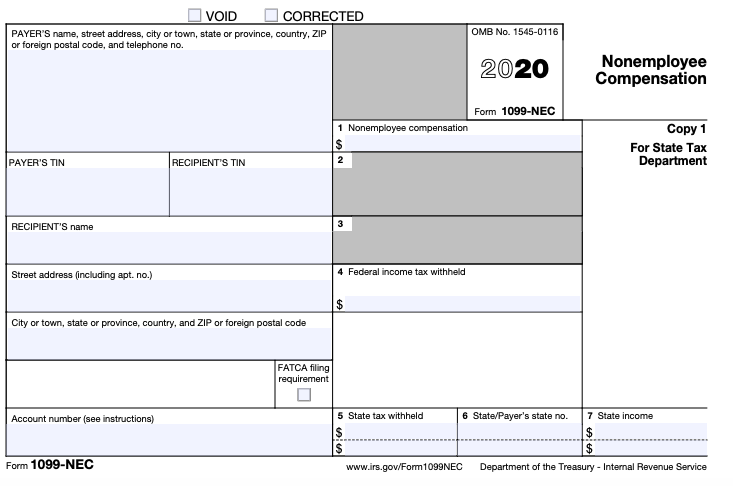

Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. Form 1099 NEC is a new federal tax form that payers must file with the Internal Revenue Service to report payments paid to none-employees such as contractors vendors consultants and the self-employed.

How To Read Your 1099 Justworks Help Center

How To Read Your 1099 Justworks Help Center

It exclusively deals with nonemployee compensations.

1099 nec business code. This is an early release draft of an IRS tax form instructions or publication which the IRS is providing for your information. Principal business code for 1099. Mark them for the Schedule C and be sure to enter a multi-form code that corresponds with the Schedule C involved.

Select the business code that best describes the type of work you are doing. The additions are relevant for the reporting year 2020. In Business Central the new 1099 Form Box codes NEC-01 and MISC-14 and a new form Vendor 1099 Nec have been added.

The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. All of the other questions usually can be left blank. These payments generally represent nonemployee compensation and up until now would typically appear in box 7.

View solution in original post. If your business has made any payments to an independent contractor for their services then such payment is deemed to be a payment made to a non-employee individual. Enter the 99M99N screens for 1099-Misc reporting or 1099-NEC for nonemployee compensation.

Businesses will need to file Form 1099-NEC in the 2021 tax season to report nonemployee compensation paid during the 2020 tax year. To see a list of codes please view pages 17-18 in the IRS link. You can see what a draft version of that form looks like here.

Form 1096 has a section where you must mark the type of form being filled. The Form 1099-NEC is the revival of a form that hasnt been used since 1982. Simply click the Lookup Business Codes button enter some keywords that describe your business eg day care.

1099 NEC for Tyler Business Forms. Tyler Business Forms is the preferred partner and recommended source for all Tyler clients forms and checks. Select Cash as the type of accounting method used.

Enter a Schedule C with the profession business code and name of the business. 1099-NEC is the latest business tax form added to the 1099 form series in 2020. Since then prior to tax year 2020 businesses typically filed Form 1099-MISC to report payments totaling 600 or more to a nonemployee for certain payments from the trade or business.

Previously companies reported this income information on Form 1099-MISC Box 7. The principle business code is a six digit code that corresponds to the type of work you perform. After a 38-year absence Form 1099-NEC made its return in the 2020 tax year.

For the last few decades business owners were responsible for using Form 1099-MISC to report nonemployee compensation. NEC stands for Nonemployee compensation. Before you submit your reporting for 2020 you must first upgrade your Business Central to handle the new requirements.

When your set up your business in TurboTax youll eventually come to the Enter Your Business Code screen. When you file Forms 1099-MISC or 1099-NEC with the IRS you must also send Form 1096 Annual Summary and Transmittal of US. The formal name of the Form 1099-NEC is Nonemployee Compensation How does form 1099-NEC work.

There is only one 1096. Examples of this include freelance work or driving for DoorDash or Uber. On the next screen select the checkbox for the Form 1099-NEC income that relates to the Schedule C.

Business codes are used by the IRS to categorize your business for statistical purposes onlyThe code you enter will not affect the outcome of your tax return. Starting in the 2020 tax year Form 1099-NEC replaces Form 1099-MISC for reporting nonemployee compensation. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made.

What is a 1099-NEC tax form.

What The 1099 Nec Coming Back Means For Your Business Chortek

What The 1099 Nec Coming Back Means For Your Business Chortek

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

What Is Form 1099 Nec For Nonemployee Compensation

What Is Form 1099 Nec For Nonemployee Compensation

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

New Small Business 1099 Nec 5part Laser Kit 20 Pack Item 89 61055

New Small Business 1099 Nec 5part Laser Kit 20 Pack Item 89 61055

What Is Form 1099 Nec Business Quick Magazine

What Is Form 1099 Nec Business Quick Magazine

I Received A Form 1099 Nec What Should I Do Godaddy Blog

I Received A Form 1099 Nec What Should I Do Godaddy Blog

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

What Is An Irs Schedule C Form And What You Need To Know About It

What Is An Irs Schedule C Form And What You Need To Know About It

1099 Nec Form Copy A Federal Discount Tax Forms

1099 Nec Form Copy A Federal Discount Tax Forms

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Update New Form 1099 Nec Alfano Company Llc

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Nec Withholding Tax Return For Nonemployee Compensation Sap Blogs

1099 Nec Withholding Tax Return For Nonemployee Compensation Sap Blogs