Sba Disaster Loan Process Covid-19

COVID-19 Economic Injury Disaster Loan. Specifically on February 24 2021 at 900 am.

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Federal Disaster Loans for Businesses Private Nonprofits Homeowners and Renters.

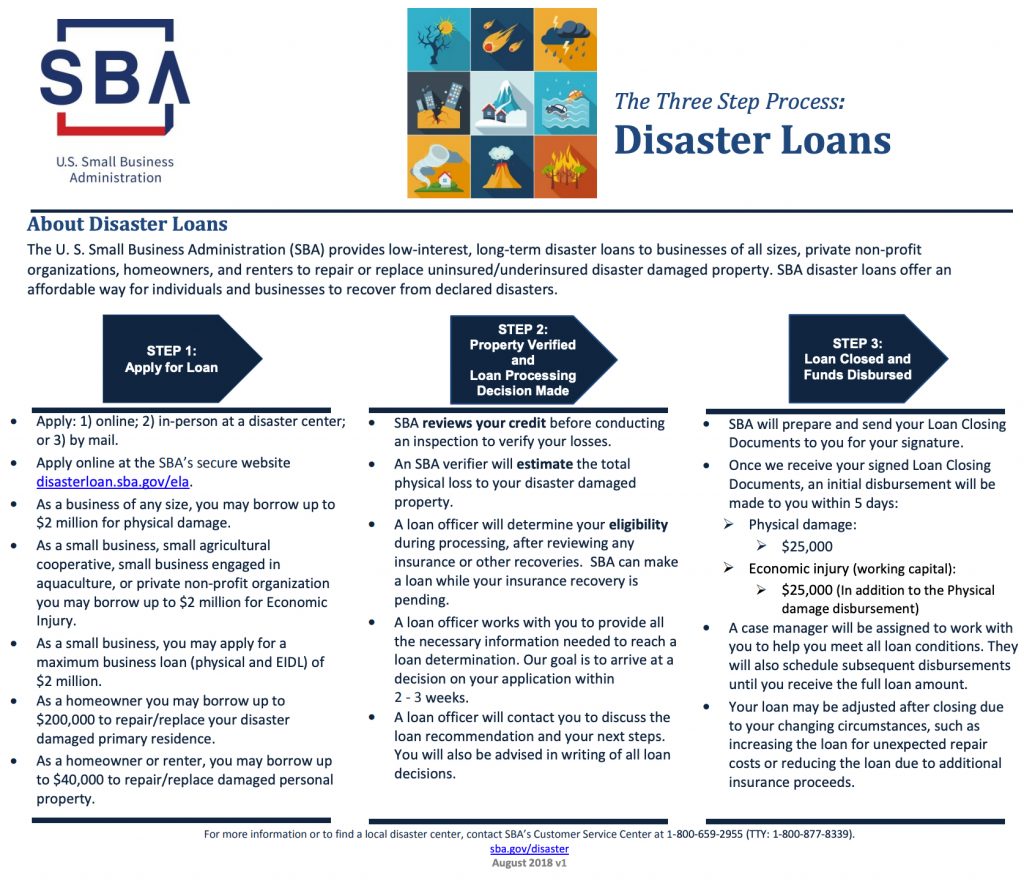

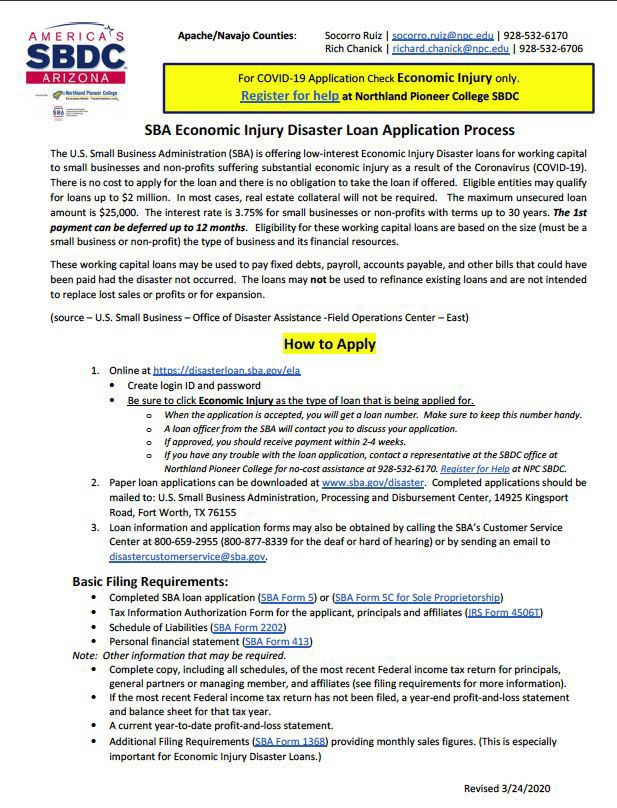

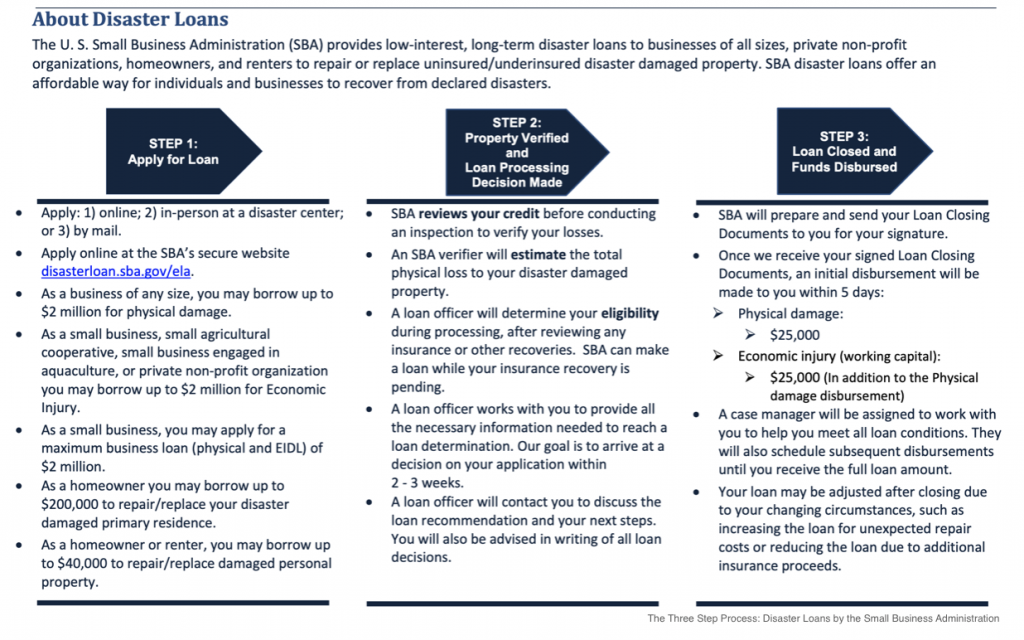

Sba disaster loan process covid-19. SBA loans are based on the borrowers credit worthiness and repayment ability and repayment terms can be up to 30 years. SBA loans are available with a federal major disaster declaration or with a SBA agency disaster declaration. Starting the week of April 6 2021 the SBA is raising the loan limit for the COVID-19 EIDL program from 6-months of economic injury with a maximum loan amount of 150000 to up to 24-months of economic injury with a maximum loan amount of 500000.

At this moment there are no more EIDL funds available as of 552020. Access your SBA Economic Injury Disaster Loan Portal Account to review your application and track your loan status. COVID-19 Small Business Loans and Assistance The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic.

If you are a small business nonprofit organization of any size or a US. 1-800-877-8339 Monday - Sunday 8 am. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue.

2 in-person at a disaster center. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. SBA Office of Disaster Assistance 1-800-659-2955 409 3rd St SW.

More than 37 million businesses employing more than 20 million people have found financial relief through SBAs Economic Injury Disaster Loans. SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. SBA disaster loans offer an affordable way for individuals and businesses to recover from declared disasters.

ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees. Agricultural business with 500 or fewer employees that has suffered substantial economic injury as a result of the COVID-19 pandemic you can apply for the COVID-19. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters.

Apply online at the SAs secure website httpsdisasterloansbagovela. CLA can help you review your EIDL options as well as other funding possibilities. SBA Economic Injury Disaster Loan EIDL Program for COVID-19.

If youre interested in a COVID-19 EIDL loan the SBAs online application process is designed to be easy and quick via their portal. On February 22 2021 President Biden announced the following changes to SBAs COVID-19 relief programs to ensure equity. As a small business small agricultural cooperative small business oengaged in aquaculture or private non-profit.

Economic Injury Disaster Loan Also known as EIDL this is another program overseen by the SBA and provides economic relief for small businesses as well as nonprofits that have suffered from a. Funds come directly from the US. DisasterLoansbagov There is no cost to apply There is no obligation to take the loan if offered The maximum unsecured loan amount is 25000 Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster but the loans cannot be consolidated.

13 hours agoSBA to make economic injury disaster loans available to agricultural businesses impacted by COVID-19 Press Release. Who can use an SBA disaster loan. As a business of any size you may borrow up to 2 million for physical damage.

The deadline to apply is December 31 2021. Disaster Loan Assistance. Or 3 by mail.

Treasury Apply directly to SBAs Disaster Assistance Program at. Call 1-800-659-2955 TTYTDD. This gave lenders and community partners more time to work with the smallest.

Relief options and Additional Resources CLICK HERE. According to the SBA SBA is unable to accept new applications at this time for the Economic Injury Disaster Loan EDIL-COVID-19 related assistance program including EIDL advances based on. Starting the week of Tuesday April 6 the SBA raised the loan limit for the COVID-19 EIDL program from 6.

For Presidential and SBA Agency declared disasters click on the Incident to view more information about the declaration. Small Business Administration is increasing the maximum amount small businesses and non-profit organizations can borrow through its COVID-19 Economic Injury Disaster Loan EIDL program.

Business Development And Support Division Sba Economic Injury Disaster Loan Program

Business Development And Support Division Sba Economic Injury Disaster Loan Program

Coronavirus Covid 19 Sba Disaster Loan Assistance Infographic Vegas Chamber

Coronavirus Covid 19 Sba Disaster Loan Assistance Infographic Vegas Chamber

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Https Www Sba Gov Sites Default Files Resource Files Covid 19 2 Choices With Ppp April 16 Ver 1 Pdf

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Sba Economic Injury Disaster Loan Faq Small Business Development Center

Tips On Applying For Sba Economic Injury Disaster Loan Nmra

Tips On Applying For Sba Economic Injury Disaster Loan Nmra

Sba Disaster Assistance In Response To The Coronavirus By Hawaii Community Foundation Issuu

Sba Disaster Assistance In Response To The Coronavirus By Hawaii Community Foundation Issuu

Coronavirus Covid 19 Small Business Guidance Loan Resources Southern Oregon Business Journal

Coronavirus Covid 19 Small Business Guidance Loan Resources Southern Oregon Business Journal

Nglcc Sba Disaster Relief Webinar Nglcc S Takeaways Nglcc Org

Sba To Provide Small Businesses Impacted By Coronavirus Covid 19 Up To 2 Million In Disaster Assistance Loans

Sba To Provide Small Businesses Impacted By Coronavirus Covid 19 Up To 2 Million In Disaster Assistance Loans

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie