How To Print 1099 Nec Form Quickbooks

The 1099-NEC tax form. Form 1099-NEC call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 not toll free.

1099 Nec Form Copy B 2 Discount Tax Forms

1099 Nec Form Copy B 2 Discount Tax Forms

Yes you can use our W2 Mate 2020 software and above to import data from QuickBooks and then prepare 1099-NEC forms for mailing to recipients or filing with the IRS.

How to print 1099 nec form quickbooks. Select the Add button on the left side of your screen to create a new 1099-MISCNEC for e-file. What our software does is it extracts the vendor information from QuickBooks such as name SSN EIN and so on along with the amounts and then allows you to direct this data. All third-party applications that support e-filing of forms 1099-NEC and 1099-MISC for QuickBooks Desktop will need to.

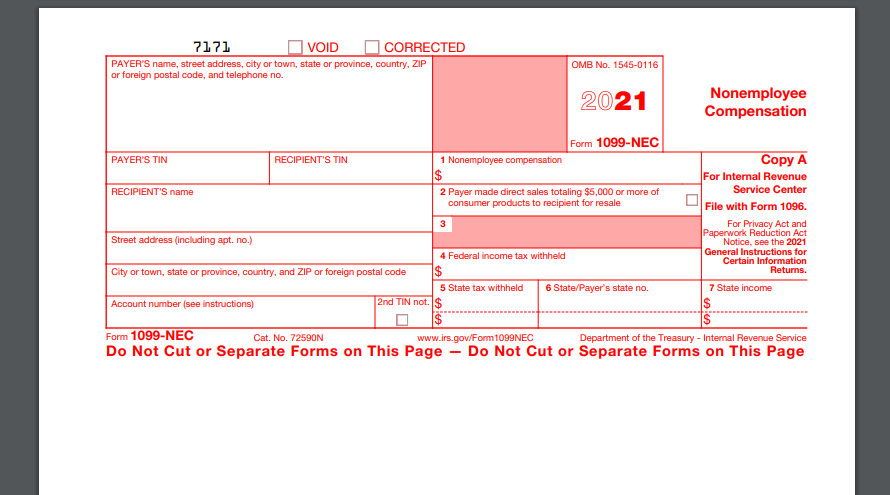

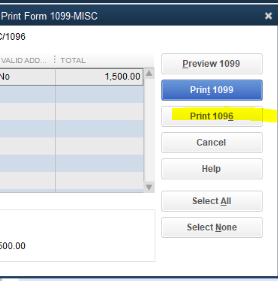

Available in quantities as low as 10 so small businesses can. To be compliant with IRS regulations QuickBooks has to support filing printing and reporting for Forms 1099-NEC and 1099-MISC along with printing Form 1096. Everything you need to print and mail QuickBooks Compatible 1099-NEC Forms in one pre-assembled set.

As a QuickBooks user you might already know by now that in order to prepare 1099-NEC forms with QB desktop you will need version 2020 and above. File Copy A of this form with the IRS. Confirm your printer setting and select.

Quickbooks needs to update to give the option to print 1099 NEC forms. Designed to print directly from QuickBooks and put information in the correct blank section of each form. Thats why we suggest you first print a couple of samples.

The 1099 form names will also show up in the 1099 transaction detail report. Persons with a hearing or speech. 1099 3921 or 5498 that you print from the IRS website.

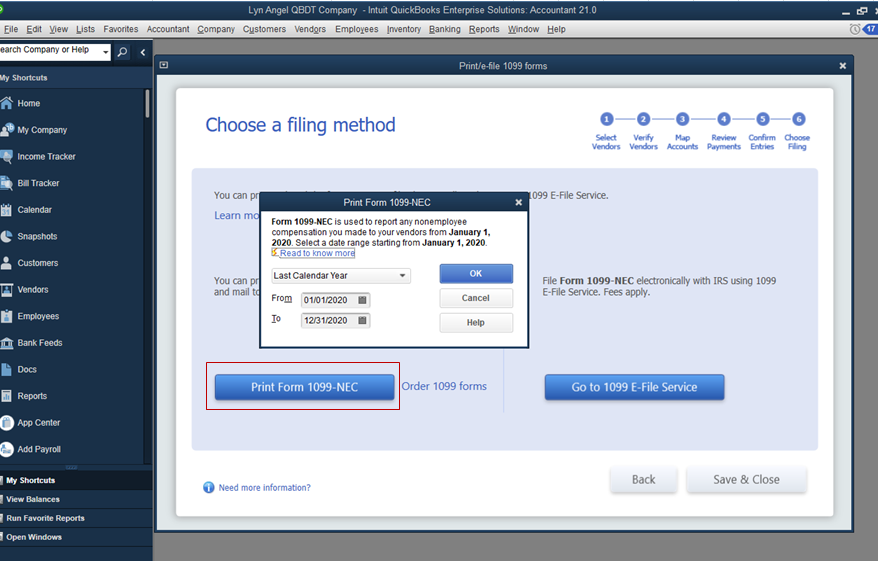

The 1099-NEC form is now used INSTEAD OF 1099-MISC to. In the Choose a filing method window select thePrint 1099-NECsor Print 1099-MISCsbutton. Scroll down to the 1099-NEC subsection.

How to Print 1099-NEC Nonemployee Compensation Forms for QuickBooks. However we can reset the payroll update to check if its available on your end. Click on PrintE-File 1099 Forms.

Create your 1099s in QuickBooks. On the pop-up click Contact us. At the moment only supported versions of QuickBooks Desktop can generate and print the form 1099 NEC.

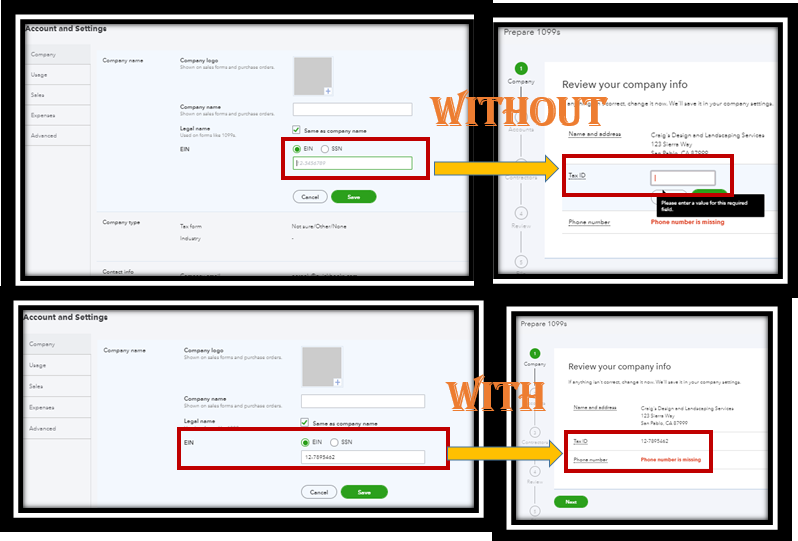

You will now see the 1099 form names right next to each box so you do not make the mistake of mapping the expense accounts to the wrong 1099 form. The printed 1099 form has to be aligned appropriately. Choose all contractors you want to print 1099s for.

If you do not want to import your data you can type inside W2 Mate and then print. Go to the Help menu and select QuickBooks Desktop Help. Newer versions of QuickBooks 2018 2019 2020 and above will support 1099-NEC.

PLEASE know that details matter. Copy A Federal red scannable Federal Copy B Recipient Copy C 2 Payer State 5pt includes 2 of these forms Compatible Envelopes with Moisture Seal or Self Adhesive Flap. Select the Print 1099-NEC or Print 1099-MISC button from the Choose a filing method window.

Enter the box 4 amount in 4 Federal income tax withheld. But instead of printing the real one click on the Print sample option. In the Choose a filing methodscreen select Print 1099s.

There are two main changes I love about the new 1099 wizard in QuickBooks Online. Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. Select the Update button.

Enter Print 1099-NEC in the question field then tap Lets talk. Choose Get Payroll Updates. Choose how you want to contact them.

Enter the box 1 amount in 1 Nonemployee compensation. Specify the date range for the forms then select OK. In addition QuickBooks needs to support third-party apps for e-filing through our SDK details below.

That way youre going to see whether it is aligned as it should be or not. Start QuickBooks and go to Vendors. So if you have QuickBooks 2019 2018 2017 or before and want to print or e-File your forms then you have to do it.

I see so many people posting the same problem and your team keeps giving the same unhelpful answer. Go to the Employees menu. Furnish Copy B of this form to the recipient by February 1 2021.

For these versions you can also use our W2 Mate to import your data and then print PDF and e-File. Open the 1099 Wizard by selecting File Print Forms 1099s1096. Create your 1099s in QuickBooks.

This new form will be used to report payments to non-employees replacing the 1099-MISC for most businesses. Specify the date range for the forms. Specify the date range for the forms then select all vendors you wish to print 1099s.

Enter the Payer Information from Form 1099-NEC. Follow the steps to finalize and double-check the info on your 1099s. Insert a blank paper in your printer and click on Print and mail as if its the final form.

Get help determining which form you need. Big difference between just print 1099s as you suggest and PRINT 1099 NEC forms. NEW 1099 FORMS FOR 2020.

Use the QuickBooks 1099 Wizard to prepare your 1099 forms for printing. QuickBooks Desktop for Mac. But Im screaming into a void here.

Nancy General October 8 2020.

Payroll Taxes Payroll Forms 1099 Forms W2 Forms 1099 Efile Quickbooks 1099 941 And 940

Payroll Taxes Payroll Forms 1099 Forms W2 Forms 1099 Efile Quickbooks 1099 941 And 940

Quickbooks Compatible 1099 Forms At Lower Prices Discount Tax Forms

Quickbooks Compatible 1099 Forms At Lower Prices Discount Tax Forms

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks The Dancing Accountant

Quickbooks The Dancing Accountant

Quickbooks 1099 Nec Form Copy A Federal Discount Tax Forms

Quickbooks 1099 Nec Form Copy A Federal Discount Tax Forms

1099 Nec Form Copy B Recipient Zbp Forms

1099 Nec Form Copy B Recipient Zbp Forms

Quickbooks 1099 Misc Form Copy B Recipient Discount Tax Forms

Quickbooks 1099 Misc Form Copy B Recipient Discount Tax Forms

Using The 1099 Wizard To Create 1099s

Using The 1099 Wizard To Create 1099s