Form K-1 1120s Instructions 2020

For detailed reporting and filing information see the specific line instructions earlier and the instructions for your income tax return. Charitable Contributions under Specific Instructions for Schedules K and K-1.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Click on column heading to sort the list.

Form k-1 1120s instructions 2020. The LLC can file a Form 1120 only if it has filed Form 8832 to elect to be treated as an association taxable as a corporation. Whats New List of codes. 08032020 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits etc.

The list of codes and descriptions are provided beginning at List of Codes Used in Schedule K-1 Form 1065 in these instructions. Schedule B-CR - Business Credit Schedule. 1 a shareholder that is a.

Changed format of Schedule K-1. Schedule K-1 no longer has a page 2 with the list of codes. Filing Requirements for Form MO-1120S.

Check the box to indicate if the number is an SSN or FEIN. The final Schedule K-1 was released on November 18 2020. Part I - Connecticut Modifications.

After applying the limitations on losses and deductions report the loss following the Instructions for Form 8582 to figure how much of the loss is allowed on Form 4797. CYE 2020 RI-1120S Return to be filed by Subchapter S Corporations. An executor is responsible to notify the partnership of the name and tax identification number.

2020 Inst 1120-S Schedule K-1 Instructions for Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc. Code G of Schedule K-1 Form 1120-S box 12 is now used to report certain cash contributions made in calendar year 2020 or 2021. You may be able to enter information on forms before saving or printing.

Instructions for Form 1120-S Schedule K-1 is used to report income deductions and credits allocated to S corporation shareholders. Shareholders Instructions for Schedule K-1 The final 2020 Form 1120-S was released on December 15 2020. 8 rows 2020 02102021 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions.

Schedule K-1 Form 1120-S and its instructions such as legislation enacted after they were published go to IRSgovForm1120S. If the amount is a loss from a passive activity see Passive Loss Limitations in the Instructions for Form 4797. Enter a term in the Find Box.

Click on the product number in each row to viewdownload. 2020 Form 1120-S Schedule K-1. Instead enter From Schedule K-1 Form 1120-S across these columns.

Return of Partnership Income. IRS Forms and Publication finder Whats new. Q-Sub schedule - Qualified Subchapter S Subsidiaries Listing.

1120S Form only. Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic-- 14-APR-2020. Charitable Contributions under Specific Instructions for Schedules K and K-1.

Form 8865 Schedule K-1 Partners Share of Income Deductions Credits etc. Indicate if this is an amended andor final Schedule CT K-1. Select a category column heading in the drop down.

Clarification to the instructions for providing concise descriptions for undisclosed tax positions UTPs on Schedule UTP Form 1120 Part III -- 06-NOV-2020. Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits etc. Certain cash contributions made in 2020 or 2021.

Every S-Corporation must file Form MO-1120S if they file Federal Form 1120S and the S-Corporation has. Generally a single-member LLC is disregarded as an entity separate from its owner and reports its income and deductions on its owners federal income tax return. Shareholders Share of Income Deductions Credits etc.

The Coronavirus Aid Relief and Economic Security Act CARES Act allows a new. Specific Instructions for Schedule CT K-1 Complete the member information section including the members Social Security Number SSN or Federal Employer Identification Number FEIN. Attach a copy of Federal Form 1120S and all Schedule K-1s.

Tax Reform Guidance for 1120 filers -- 09-APR-2018. Rhode Island Schedule K-1 Instructions. Other income loss Code A Other portfolio income loss.

New employee retention credit. Inst 1120-S Schedule K-1 Instructions for Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc. Schedule K-1 Codes Form 1120-S S Corporation List of Codes This list identifies the codes used on Schedule K-1 for all shareholders.

Most loss deduction and credit items reported on the Schedule K-1 may require adjustment based on basis limitations at. Inst 1120-S Schedule D Instructions for Schedule D Form 1120S. 2020 07022020 Inst 1120-S Schedule M-3 Instructions for Schedule M-3 Form 1120-S Net Income Loss Reconciliation for S Corporations With Total Assets of 10 Million or More 1119 09102019.

1120S Form only. Or 2 any income derived from Missouri sources Section 143471 RSMo. Code G of Schedule K-1 Form 1120-S box 12 is now used to report certain cash contributions made in calendar year 2020 or 2021.

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

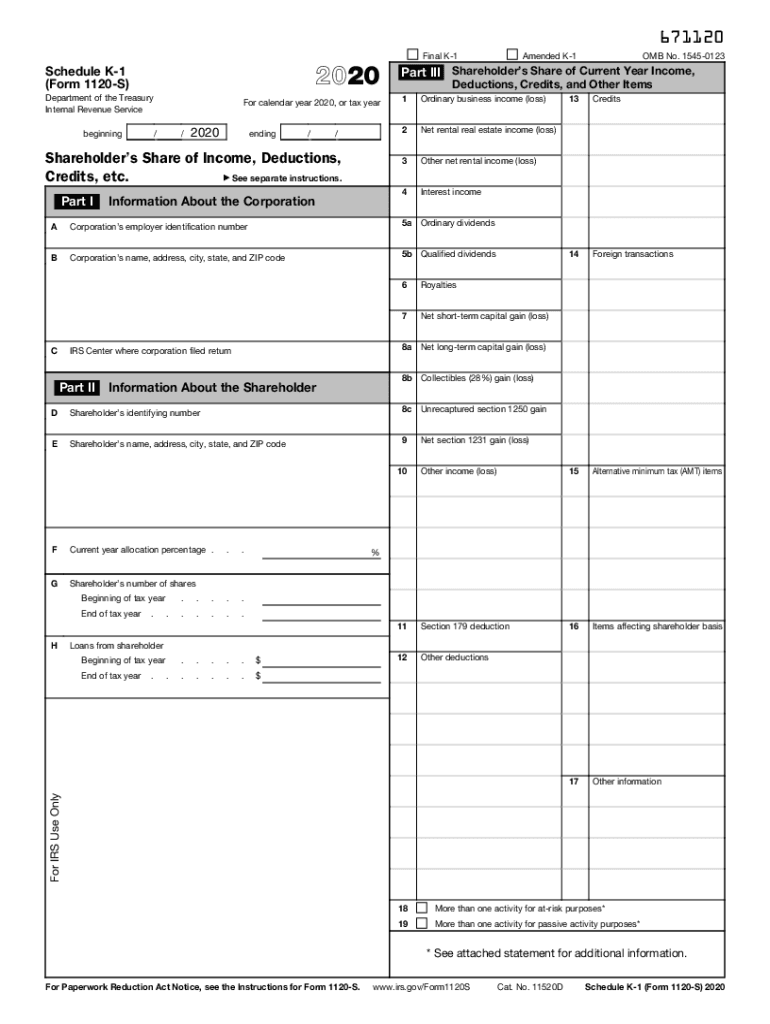

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

What Is Form 1120s And How Do I File It Ask Gusto

What Is Form 1120s And How Do I File It Ask Gusto

What Is Form 1120s And How Do I File It Ask Gusto

What Is Form 1120s And How Do I File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

2020 Form Irs Instruction 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs Instruction 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Shareholder S Instructions For Schedule K 1 Form 1120s Stambaugh Ness

Shareholder S Instructions For Schedule K 1 Form 1120s Stambaugh Ness

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

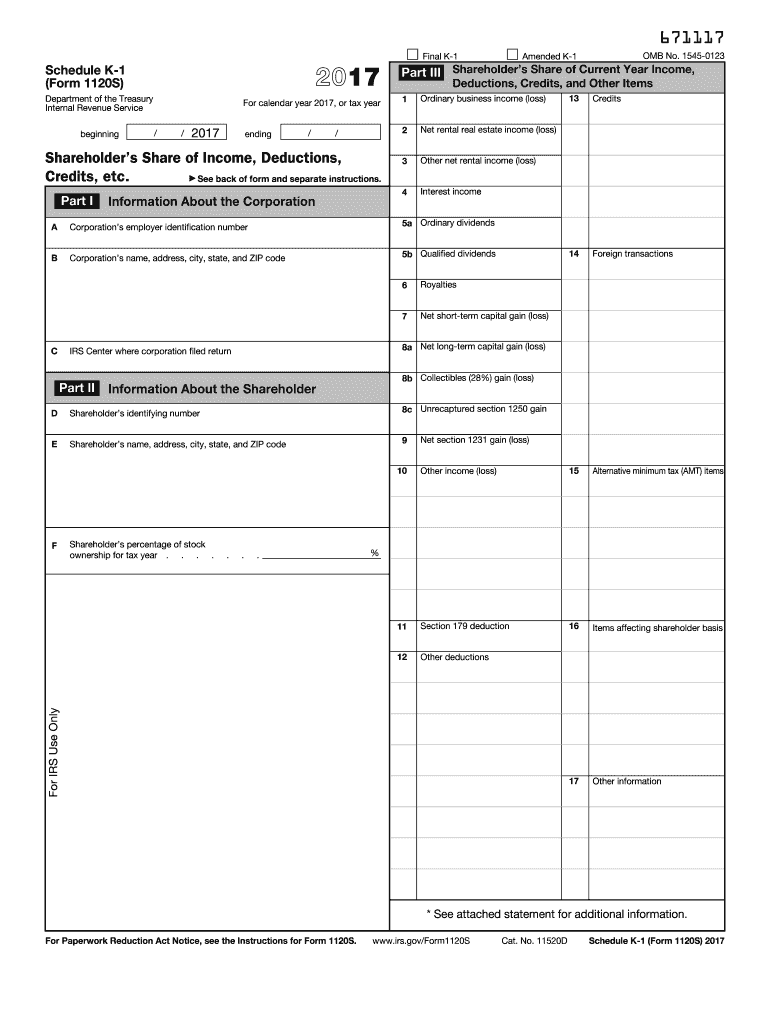

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller