Where To Mail 1099 Misc Forms To Irs Texas

Reportable payments to corporations. Box 1300 Charlotte NC 28201-1300.

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

Click on Employer and Information Returns and well mail you the forms you request and their instructions as well as any publications you may order.

Where to mail 1099 misc forms to irs texas. 31 st of January 2021. Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file. The Social Security Administration shares the information with the Internal Revenue Service.

Department of the Treasury Internal Revenue Service Center Austin TX 73301. B Copies B C and 1. The IRS mailing address for the forms is as follows.

Alabama Arizona Arkansas Delaware Florida Georgia Kentucky Maine Massachusetts Mississippi New Hampshire New Jersey New Mexico New York North Carolina Ohio Texas Vermont Virginia. 24 posts related to Where To Mail Form 1099 Misc In Texas. Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC.

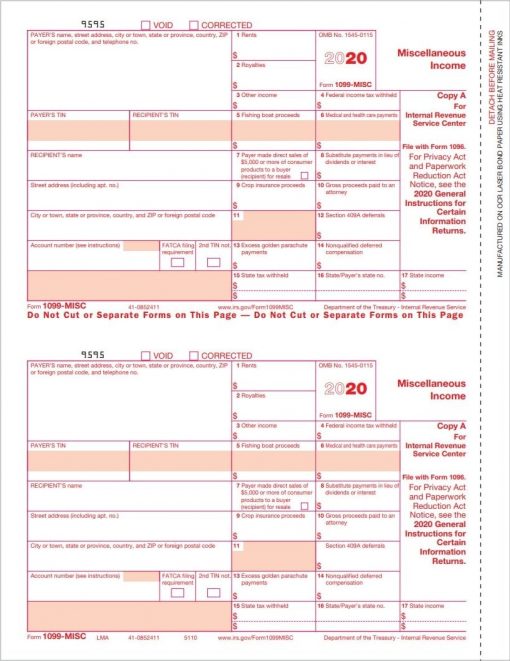

1099 Forms Form 1099 NEC Form 1099 MISC Form 1099 INT Form 1099 DIV Form 1099 R Form 1099 S Form 1099 B Form 1099 K Form 1099 C Form 1099 G Form 1099 PATR Form 1099 Corrections 1099 State Filings Form 1098-T. A Copy A for the Internal Revenue Service two different forms per page. 1099 Misc Template For Preprinted Forms 2016 Unique 1099s Form Lovely Irs 1099 Misc Form Free Download Create Fill And.

Department of the Treasury Internal Revenue Service. Department of the Treasury Internal Revenue Service Austin TX 73301-0052. Viewing your IRS 1099-G information over the Internet is fast easy and secure.

Here is the TT instruction page for 1099-MISC and 1099-NEC. Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. Internal Revenue Service PO.

Internal Revenue Service PO. Department of the Treasury Internal Revenue Service Center Austin. Future Developments For the latest information about developments related to Form 1099-MISC and its instructions such as legislation enacted after they were published go to IRSgov.

CAPPS agencies use USAS for their 1099 reporting. Form 1099-MISC Miscellaneous Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. You can request the IRS to mail the forms to you.

To view your. Wage Tax Forms Form W-2 Form W-2c Form W-2PR W-2 State Filings. Copy C for your records.

About Form 1099-MISC Miscellaneous Income About Form 1099-S Proceeds from Real Estate Transactions About Form 8233 Exemption From Withholding on Compensation for Independent and Certain Dependent Personal Services of a Nonresident Alien Individual. To get instant status of your returns filed with the IRS choose to e-file Form 1099-NEC. The IRS and all other applicable copies of the form visit wwwIRSgovorderforms.

Information returns may also be filed electronically using the IRS Filing Information Returns. If you have specific questions about the reportability of payments or other 1099 issues contact the Internal Revenue Service IRS at 866 455-7438. Mail Form 1099-MISC to.

Instructions for Forms 1099-MISC and 1099-NEC 2020 Reportable payments to corporations. You will receive the requested forms within 10 business days through US Postal Services. For assistance with USAS-generated 1099 forms and reports contact the 1099 Help Line 512 463-6307.

The Internet is available 24 hours a day 7 days a week in English and Spanish. Payers use Form 1099-MISC Miscellaneous Income or Form 1099-NEC Nonemployee Compensation to. Internal Revenue Service PO.

Online W4 W9 W8s Form W-4 Form W-9 Free Form W-8BEN. Wage Tax Forms Form W-2 Form W-2c Form W-2PR W-2 State Filings. Remember that you have to send such a request at least 30 days before the due date ie.

Internal Revenue Service Center Ogden UT 84201. Online W4 W9 W8s Form W-4 Form W-9 Free Form W-8BEN. Log on to Unemployment Benefits Services.

Select the link View IRS 1099-G Information and 3. 1099 Forms Form 1099 NEC Form 1099 MISC Form 1099 INT Form 1099 DIV Form 1099 R Form 1099 S Form 1099 B Form 1099 K Form 1099 C Form 1099 G Form 1099 PATR Form 1099 Corrections 1099 State Filings Form 1098-T. Box 1214 Charlotte NC 28201-1214.

Use this link to request the IRS for your 1099-MISC forms and other forms. Copy B for the recipient. 1 For each Form 1099-NEC you should have the following copies.

Instructions for filing Forms 1099-NEC and 1096. Department of the Treasury Internal Revenue Service Center AustinTX 73301. February 23 2019 by Mathilde Émond.

Where To Mail Form 1099 Misc In Texas. Outside the United States. Box 1300 Charlotte NC 28201-1300.

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Amazon Com 1099 Misc Forms 2020 1099 Misc Laser Forms Irs Approved Designed For Quickbooks And Accounting Software 2020 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 54 105 Forms Office Products

Amazon Com 1099 Misc Forms 2020 1099 Misc Laser Forms Irs Approved Designed For Quickbooks And Accounting Software 2020 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 54 105 Forms Office Products

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Https Www Diocesewma Org Wp Content Uploads 2017 11 2017 Irs Form 1099 1096 Filing Instructions Deadlines Pdf

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Quickbooks 1099 Misc Forms Set Discount Tax Forms

Quickbooks 1099 Misc Forms Set Discount Tax Forms

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)