How Do Small Business Loans Work Covid 19

The Targeted EIDL Advance provides businesses in low-income communities with additional funds to ensure small business continuity adaptation and resiliency. Unlike some small business loans intended to pay for long-term assets or investments working capital loans are used to finance the everyday operations of your business.

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

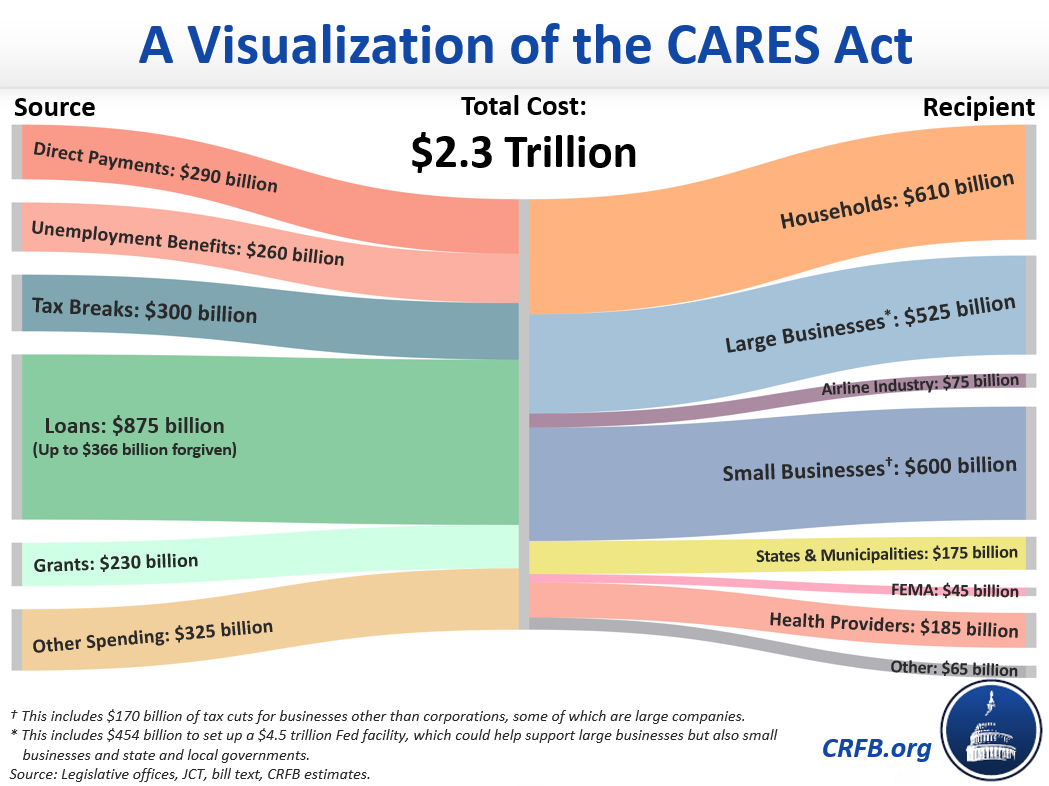

The Treasury Department is providing needed relief to state local and Tribal governments to enable them to continue to support the public health response and lay the foundation for a strong and equitable economic recovery.

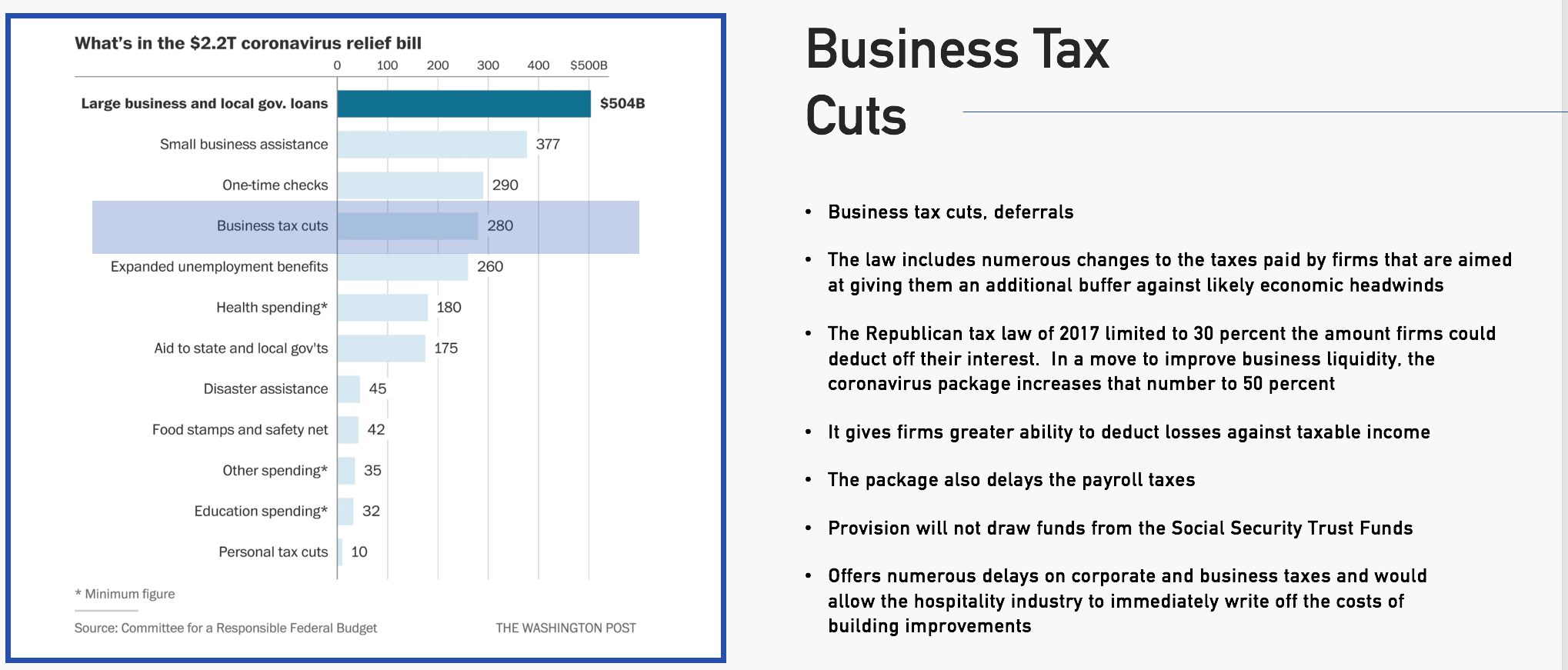

How do small business loans work covid 19. One uncertainty for businesses concerns the federal Paycheck Protection Program PPP which started as loans to businesses so they could keep employees on. 17Minnesota Chamber of Commerce President Doug Loon has a simple request for the Legislature. What You Need To Know Congress has made 349 billion available in loans to small businesses much of.

Small business owners in all US. The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic. Businesses are struggling to survive pandemic restrictions and any additional tax burden could tip the scales.

Businesses can use a loan to obtain or retain overseas customers by offering attractive payment terms. The loan can be forgiven if. The interest rate for PPP loans are 1.

These operations can include things like rent payroll and debt payments. Small Business Loans for COVID-19 Financial Assistance. The COVID-19 public health crisis and resulting economic crisis have put state local and Tribal governments under unprecedented strain.

For example identifying a new overseas customer should an export sale be lost due to COVID-19. Those affected can describe their losses Eligible small businesses must complete an Economic Injury Worksheets detailing the economic losses they have suffered due to the coronavirus. Paycheck Protection Program PPP The Paycheck Protection Program PPP offers loans to help small businesses and non-profits keep their workers employed.

Programs have been quickly crafted everywhere from the halls of Congress to tiny town halls across America. In response the federal government has created and expanded several assistance programs for certain impacted businesses including a paycheck protection program PPP. COVID-19 April 6 2020 FAQs.

COVID-19 Small Business Loans and Assistance. Small Business Loans for COVID-19 The coronavirus of 2019 COVID-19 has caused unprecedented disruption for small businesses in the United States. States territories and Washington DC are currently eligible to apply for a low-interest loan of up to 2 million due to.

Compared with other small business loans working capital loans feature shorter terms and lower amounts. NFIB Research found that three-quarters of small business owners have applied for loans due to the negative impact of the COVID-19 outbreak. The COVID-19 Targeted EIDL Advance was signed into law on December 27 2020 as part of the Economic Aid to Hard-Hit Small Businesses Non-Profits and Venues Act.

The PPP authorizes up to 349 billion in forgivable loans to small businesses to prevent more layoffs and allow companies keep their employees on the payroll during the COVID-19 pandemic. The EIDL can give business owners fast relief through emergency grants up to 10000 that do. A variety of loan and grant programs have sprung up as businesses have shut down because of the COVID-19 pandemic.

Export Working Capital loans enable small businesses to fulfill export orders and finance international sales by providing revolving lines of credit or transaction-based financing of up to 5 million. Just about every lendercredit card companies mortgage lenders student loan servicers and othershas been offering some sort of assistance for their borrowers who have been affected by COVID-19. Coronavirus Small Business Loan Application Process Heres how small businesses can apply for an EIDL.

Through the PPP businesses with up to 500 employees and some other companies can receive a loan for 25 times their monthly payroll costs up to 10 million. The Coronavirus Small Business Loan Program.

Covid 19 Ma Small Business Development Center Network Umass Amherst

Covid 19 Ma Small Business Development Center Network Umass Amherst

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

Small Business Administration Sba Loans Immediately Available To Child Care Providers First Five Years Fund

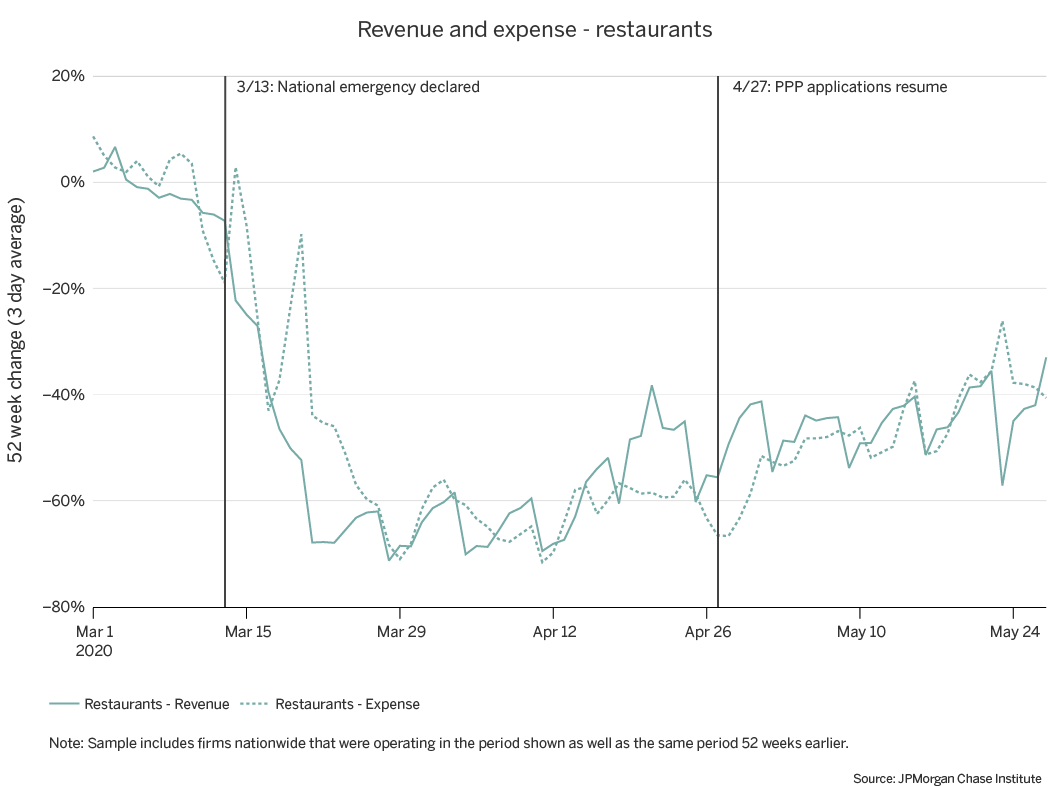

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Financial Outcomes During The Covid 19 Pandemic

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

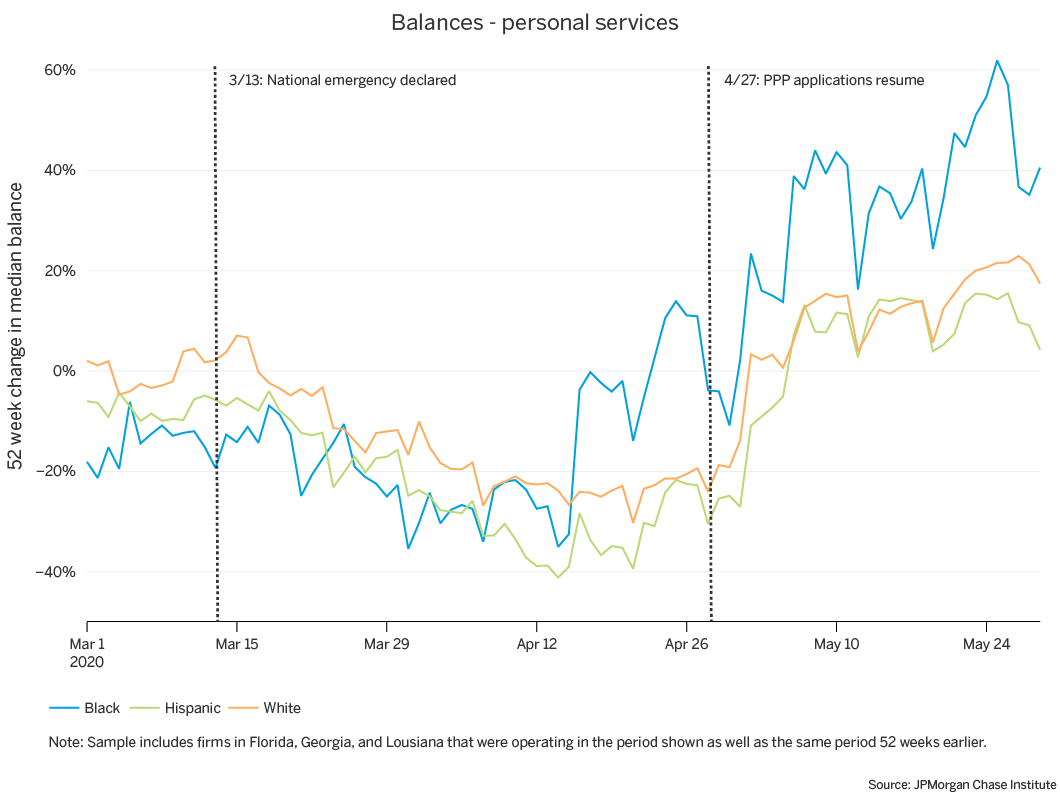

New Data Shows Small Businesses In Communities Of Color Had Unequal Access To Federal Covid 19 Relief

New Data Shows Small Businesses In Communities Of Color Had Unequal Access To Federal Covid 19 Relief

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Loan Programs The U S Small Business Administration Sba Gov

Loan Programs The U S Small Business Administration Sba Gov

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Aa Los Angeles County Economic Development Corporation

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

Small Business Challenges During Covid 19 How To Overcome Them

Small Business Challenges During Covid 19 How To Overcome Them

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Paycheck Protection Program How It Works Funding Circle

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

List Of Coronavirus Covid 19 Small Business Loan And Grant Programs

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Financial Outcomes During The Covid 19 Pandemic

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus