Florida Business License Sole Proprietorship

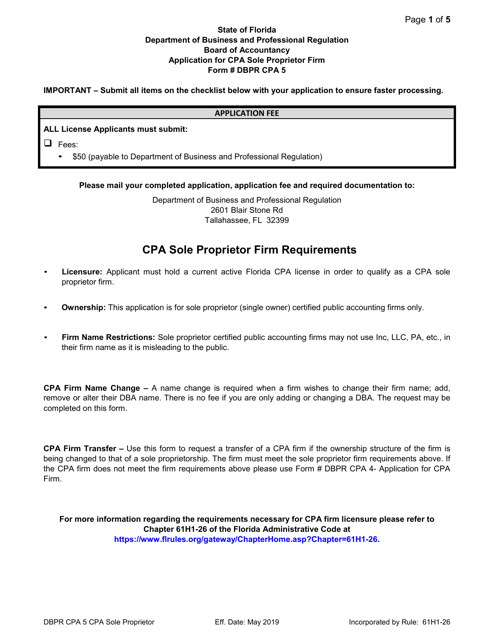

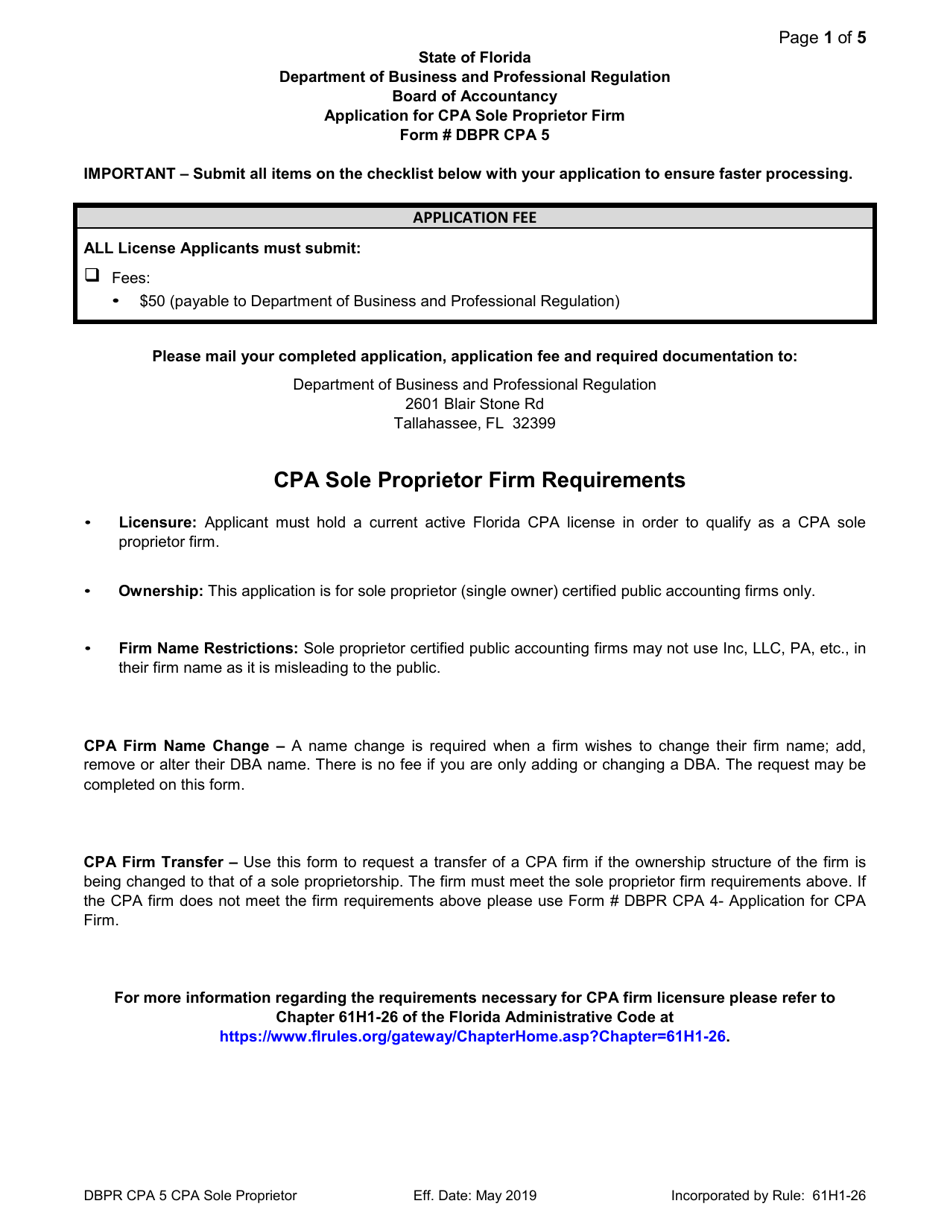

If youre a Sole Proprietor you need a DBA to register your business name DBA is an abbreviation for doing business as Well prepare and file all required documents to start your Florida DBA Get started Starting at 99 state filing fees. Choose a Business Name.

What Business Licenses Are Needed In Florida Starting A Business In Florida Youtube

What Business Licenses Are Needed In Florida Starting A Business In Florida Youtube

How to Establish a Sole Proprietorship in Florida 1.

Florida business license sole proprietorship. The Florida Department of State is committed to our customers and we are implementing critical investments to our systems and processes which will improve efficiency and security for Florida businesses. A sole proprietorship is a business where a single owner has complete control over a business enjoys all the profits makes all decisions and has the liability and responsibility for the debts and obligations of the business. Comply with new hire requirements.

If you hire employees you must file new-hire reports and register for. Handyman etc you will need to register the business name by filing a. You are entitled to all profits and are responsible for all your businesss debts losses and liabilities.

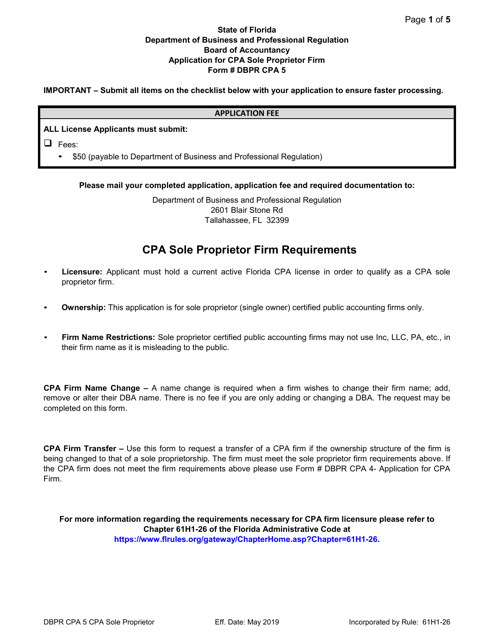

A sole proprietorship is not recognized as an entity separate from its owner or proprietor and is not taxed separately. 1 Requirements for CPA Sole Proprietor Firm Licensure. Register with the Florida Department of Revenue DOR.

Choosing a Business Ownership Structure. It is an unincorporated business owned and operated by one individual with no distinction between the business and the owner. University of North Florida Small Business Development Center.

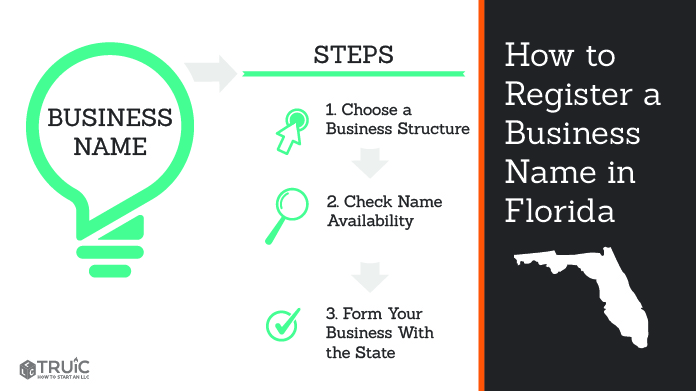

If you opt for another name you must comply with applicable Florida and local licensing requirements in order to operate legally and without hassles. Whatever you choose you need to register your company with the state county and obtain a bank account for the company. The primary ownership structures for businesses include the following.

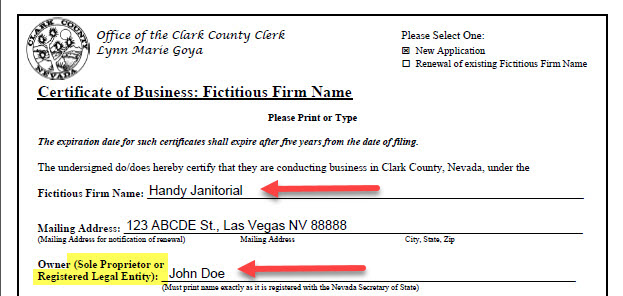

Third obtain any licenses required to operate your business. Complying with Ongoing Requirements 1. Sole proprietorships when not operating under the owners legal name must register a fictitious name with the Division of Corporations.

If you are a sole proprietorship in Florida and doing business under your full first and last name John Smith for example there is no filing but if the business will operate under a Fictitious Name sometimes referred to as an assumed name trade name or Doing Business AsDBA like John Smiths Handyman Service Mr. B This application is for sole proprietor single owner certified public accounting firms only. A sole proprietorship is the simplest and most common structure chosen to start a business.

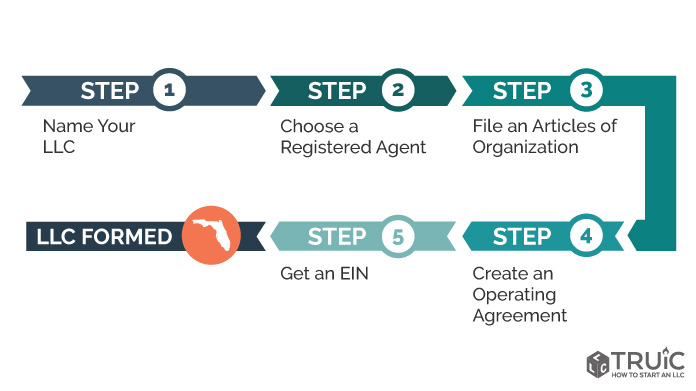

Registering a sole proprietorship in the State of Florida is a simple straightforward process. If you use a business name that is different from your legal name Florida requires you to. First select an available business name.

Incorporate as a corporation or LLC Limited Liability Company. GETTING YOUR Miami Florida Miami Business License You can use a Business License to hang on your Business Location and be legal. File a Trade Name.

It is an unincorporated business owned and run by one individual with no distinction between the business and you the owner. Under the department of Florida state law a sole proprietorship can operate under the business owners name or use a different name Doing Business As DBS. File a DBA fictitious name to create a sole proprietorship or partnership.

At this time due to the high volume of filing activity in conjunction with the implementation of these upgrades there will be a delay in. A Applicant must hold a current active Florida CPA license in order to qualify as a CPA sole proprietor firm. A legal representative and accountant should be consulted before making a determination as to the type of business entity to form.

Sole Proprietorship A sole proprietorship is the simplest and most common structure chosen to start a business. In Florida a sole proprietor may use his or her own given name or may use an assumed name or. In order to collect business tax you must register with the.

There isnt a requirement in Florida for sole proprietors to acquire a general business license but depending on the nature of your business you may need other licenses andor permits to operate in a compliant fashion. Second register your business name with the State of Florida. You still need DBA Business Name Registration as a sole proprietor to open a business bank account and bring law suits against others as well as receive money using a name other than your family legal name.

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida

How To Set Up A Sole Proprietorship In Florida 15 Steps

How To Set Up A Sole Proprietorship In Florida 15 Steps

How To Register A Business Name In Florida

How To Register A Business Name In Florida

Florida Certificate Of Authority Foreign Florida Corporation

Https Www Jacksonvillebeach Org Sites Default Files Documents Local Bus Tax Form Pdf

Doing Business In The State Of Florida Florida Businesses

Doing Business In The State Of Florida Florida Businesses

How To Open A Sole Proprietorship Business In Florida Legalzoom Com

How To Open A Sole Proprietorship Business In Florida Legalzoom Com

Form Dbpr Cpa5 Download Printable Pdf Or Fill Online Application For Cpa Sole Proprietor Firm Florida Templateroller

Form Dbpr Cpa5 Download Printable Pdf Or Fill Online Application For Cpa Sole Proprietor Firm Florida Templateroller

Do I Need A Florida Business License Sagacity Legal Blog

Do I Need A Florida Business License Sagacity Legal Blog

Form Dbpr Cpa5 Download Printable Pdf Or Fill Online Application For Cpa Sole Proprietor Firm Florida Templateroller

Form Dbpr Cpa5 Download Printable Pdf Or Fill Online Application For Cpa Sole Proprietor Firm Florida Templateroller

Business License Application Form Fl Page 1 Line 17qq Com

Business License Application Form Fl Page 1 Line 17qq Com

How To Form An Llc In Florida Startingyourbusiness Com

How To Form An Llc In Florida Startingyourbusiness Com

Florida Foreign Llc Registration Get A Florida Certificate Of Authority

Https Www Miamidade Gov Licenses Library Forms Personal And Business Sole Pdf

Florida Llc 47 Out The Door Florida Llc Formation

Http Www Polktaxes Com Localbusinesstaxes Forms Bt 20application 20october 20through 20june 10042017 Pdf

Http Www Egovlink Com Public Documents300 Winterhaven Published Documents Winter 20haven Business 20tax 20receipt Btr 20application Pdf

Doing Business As Sole Proprietorship In Florida Fl Patel Law Pllc

Doing Business As Sole Proprietorship In Florida Fl Patel Law Pllc