Does A Vendor Get A 1099

The company does not deduct taxes from a vendors 1099 payment and must report the amount of payments made to each vendor to the Internal Revenue Service. 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC.

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

You may begin to receive these documents as.

Does a vendor get a 1099. And heres a final tip. If you hire a 1099 vendor to perform work at your business do not include them on your companys payroll. A person is engaged in business if he or she operates for profit.

It would be a 1099-Misc. If you did not sell more than 600 for that person then you do not need to send a 1099-Misc. See the separate Instructions for Form 1099-K.

If you would like to read more about 1099-Misc please visit this IRS page. What is a 1099 Vendor. If You Paid Someone 10 Or More For Natural Resources Forestry or Conservation Grants.

On the other hand not filing one that is required can lead to hefty penalties. With this tool it wont matter how many copies of 1099 go to recipient. If you paid a vendor more than 10 in interest youve got to send out a 1099-INT.

Any business owner company or employer who secures outside services from a vendor contractor or subcontractor is required to file a 1099-MISC form with the IRS. The W21099 forms filer from AMS is a great place to start. The 1099-INT form is usually used by banks brokerage firms credit unions and sometimes even the companies handling your student loans.

On the W9 they should be indicating what type of tax classification their business falls under. You do not need to send this form to vendors of storage freight merchandise or related items or when rent is paid to a real estate agent. The exception to this rule is with paying attorneys.

Payments made by PayPal or another third-party network gift card debit card or credit card also dont require a 1099. If your vendor is a corporation a C Corp or an S Corp you do not need to issue them a 1099. Less-reputable vendors might not be around when you need their information at tax time.

A 1099 vendor is a designation listed in each of the records in the vendor master file that is part of an accounting software package. Always get the W-9 before you issue payments to any vendor who may be required to get a 1099-NEC. Instead a 1099 vendor will send you a 1099 invoice after performing work for.

Typically youll receive a 1099 because you earned some form of income from a non-employer source. According to the North Carolina Office of the State Controller 1099 vendors are trade and non-trade entities or individuals that provide goods services or contract work for a company. The company then sends the resulting 1099 form to the supplier.

They are not an employee so they do not receive hourly or salary wages for each payroll period. 1099 Rules Regulations Who must file. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

The easiest way to get these 1099s completed and submitted is to invest in a software solution. Vendors who operate as C- or S-Corporations do not require a 1099. If you paid your 1099 recipients with only cash or check this legislation does not apply to you.

Users can draft and distribute every type of W-2 and 1099. You should get a form W-8BEN signed by the foreign contractor. You need to send 1099s to the people whose work you sold IF you sold more than 60000 for that person in the year.

If you designate a supplier as a 1099 vendor the system will print a Form 1099 for the supplier as part of the 1099 batch processing that follows the end of the calendar year. While most 1099 vendors for school business are IndividualSole Proprietors they could also be C Corporation S Corporation Partnership TrustEstate Limited Liability Company or Other. January 15 2019 0653 AM As long as the foreign contractor is not a US.

A payment to an informer as an award fee or reward for information about criminal activity does not have to be reported if the payment is made by a. You will need to provide a 1099 to any vendor who is a. Fees paid to informers.

If the independent contractor is a sole proprietor the SSN is preferred. Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made. Thus personal payments arent reportable.

The tax-exempt organization will need the social security number or EIN of an independent contractor to complete Form 1099-MISC. If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. They must then also send copies of this form to their contractors subcontractors vendors and service suppliers.

You need to file 1099 forms and have paid 1099 vendorscontractors using payment types other than cash or check such as debit card credit card or third party networking companies like PayPal. Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor.

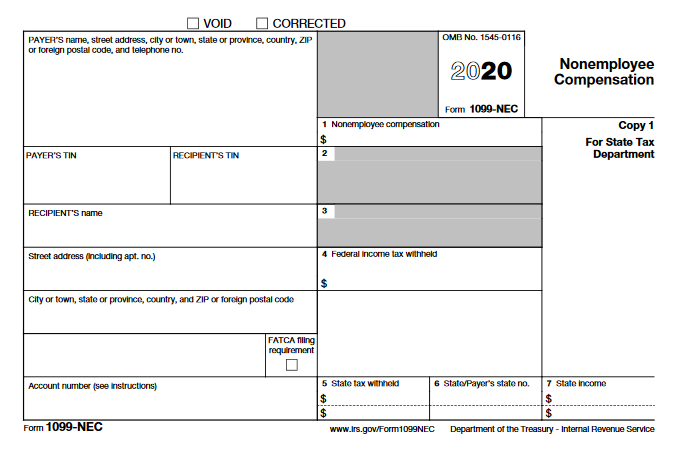

How Vendor Maintenance May Need To Prepare In 2020 For The Expected Irs 1099 Nec Form Irs Accounts Payable Maintenance

How Vendor Maintenance May Need To Prepare In 2020 For The Expected Irs 1099 Nec Form Irs Accounts Payable Maintenance

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

1099 Forms Free Download 1099 Forms Free Driverlayer Search Engine Irs Forms 1099 Tax Form Tax Forms

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Online Marketing Quotes Small Business Tax

Everything You Need To Know About 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Online Marketing Quotes Small Business Tax

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Best Practices For 1099s And W 9s In 2019 Accounting Tax Advisory Services

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

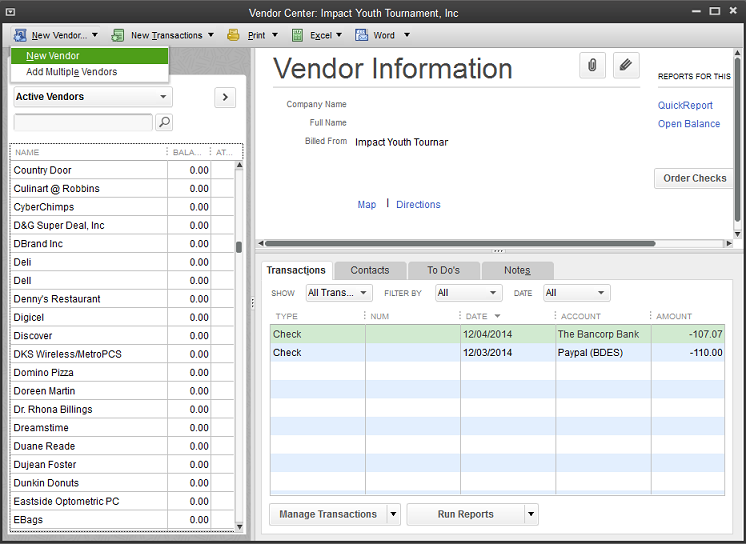

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

Do You Want To Track Your 1099 Payments In Wave Accounting Yes You Say Well Here Is A Blog Post Just Fo Wave Accounting Business Read Bookkeeping Software

Do You Want To Track Your 1099 Payments In Wave Accounting Yes You Say Well Here Is A Blog Post Just Fo Wave Accounting Business Read Bookkeeping Software

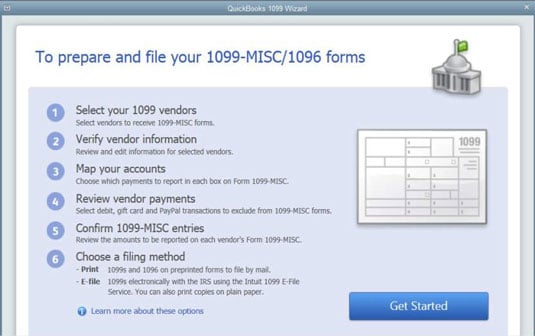

Producing 1099s For Vendors And Contractors Dummies

Producing 1099s For Vendors And Contractors Dummies

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

1099 Misc Check 1042s Check Irs B Notices Check Realized Your Vendor Master File Needs Teaching Management Accounts Payable Cybersecurity Training

What Is A 1099 Misc And How Does It Work The Korean Accountant What Is A 1099 Business Content Does It Work

What Is A 1099 Misc And How Does It Work The Korean Accountant What Is A 1099 Business Content Does It Work

Very Timely Collect Those W 9s Now To Get Ready For Irs Reporting And 1099 Distribution How To Collect Vendor W 9s Before Accounts Payable To Collect Vendor

Very Timely Collect Those W 9s Now To Get Ready For Irs Reporting And 1099 Distribution How To Collect Vendor W 9s Before Accounts Payable To Collect Vendor

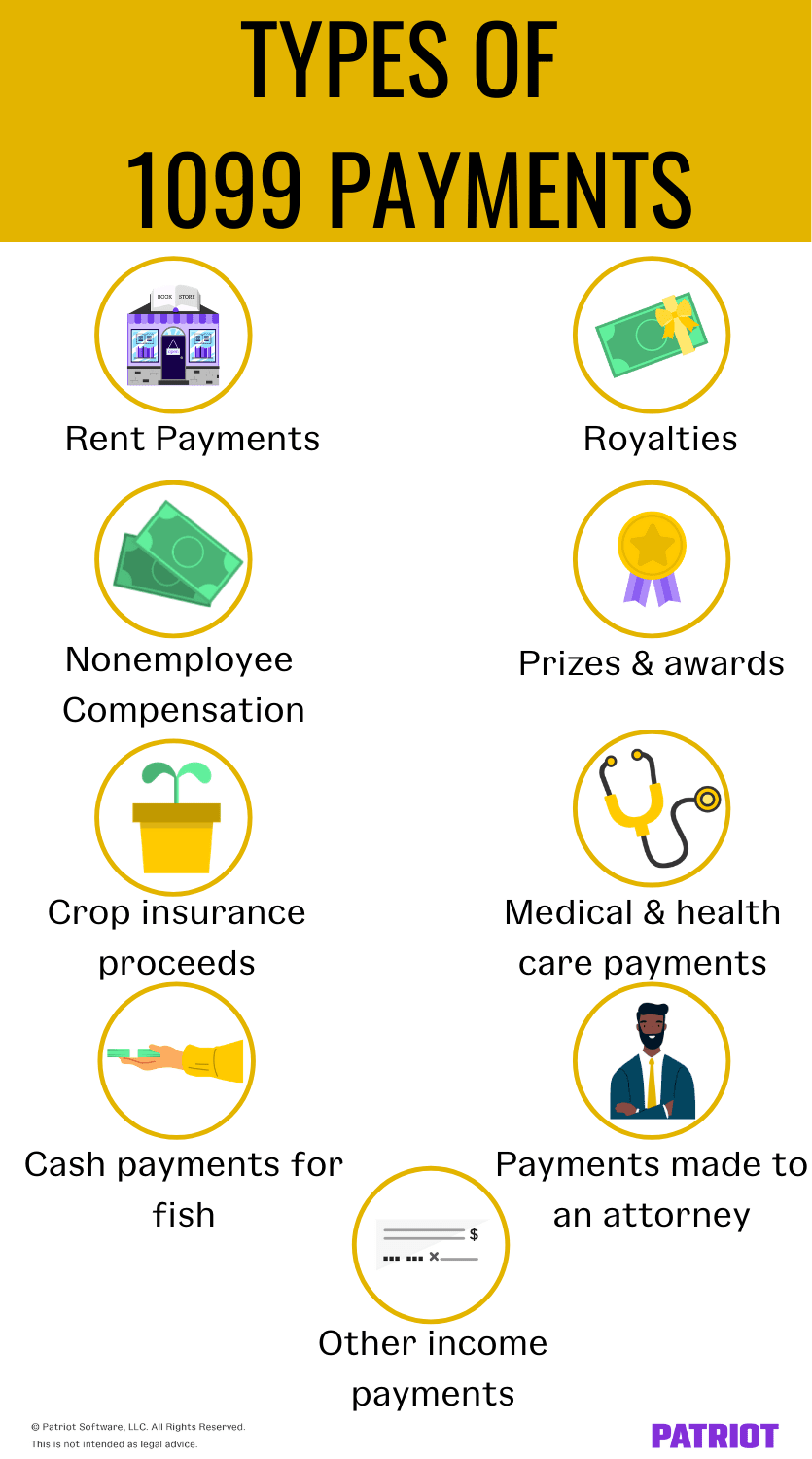

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors