Does An Llc Corp Get A 1099

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. If their LLC is taxed as an S- or a C-Corp you do not unless an exception applies as described above.

S C Corp Or Llc For Your Blog Comparison Chart Business Checklist Business Blog

S C Corp Or Llc For Your Blog Comparison Chart Business Checklist Business Blog

Payments for merchandise telegrams telephone freight storage and similar items.

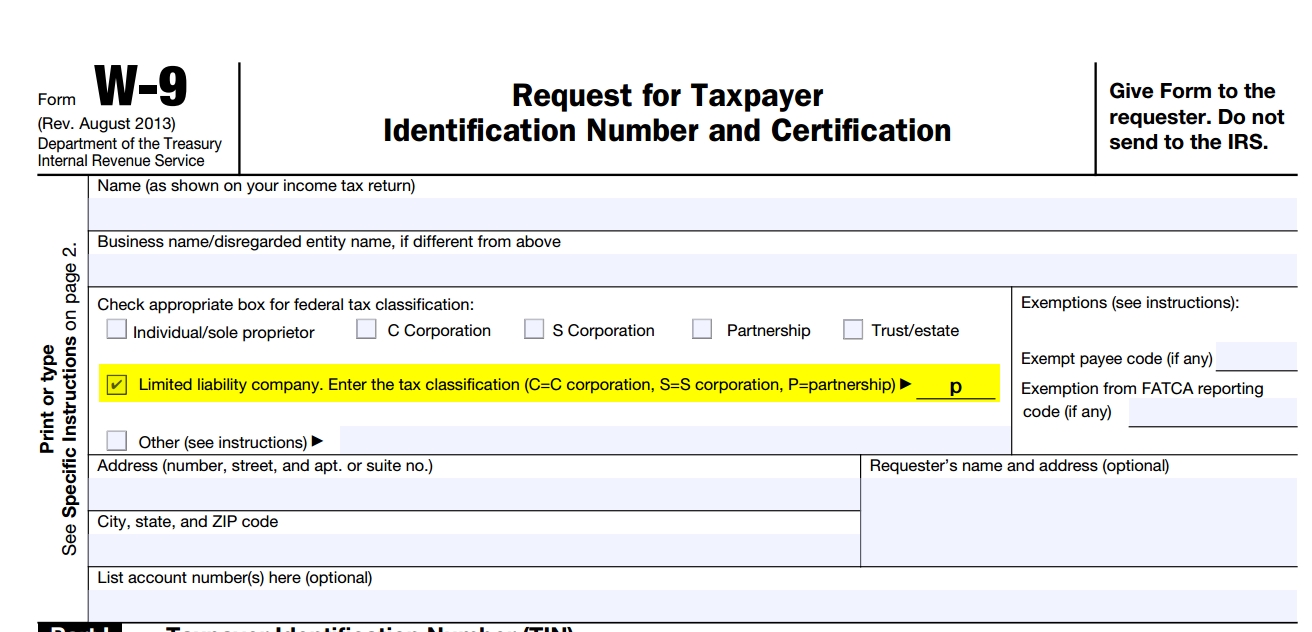

Does an llc corp get a 1099. Just look at the W-9 the worker provided. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600.

If the LLC has multiple members and is not taxed as a corporation the LLC is taxed as a partnership. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc. An easy way to tell.

There is no need to send 1099-MISCs to corporations. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. For contractors that operate and file taxes as corporations such as a C-corp.

The funny part about this is that if you are the one issuing a Form 1099-MISC you will have no way to tell if the vendor you are issuing to is an s-corporation since the business name will only include LLC in the title. An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations. However the real estate agent or property manager must use Form 1099-MISC to report the rent paid over to the property owner.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. LLC with S or C corporation status No 1099-MISC The business that made the payment to the independent contractor is the one who must report the payments to the IRS and then send a copy to the provider. The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee.

If the W-9 indicates they are an LLC that is taxed as a sole proprietorship you need to send a 1099. If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099. However if your independent contractor has their business established as a corporation either an S Corp or a C Corp then for tax purposes they would be considered as such and would not typically be filing Form 1099s.

However see Reportable payments to corporations later. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form.

A Limited Liability Company LLC is an entity created by state statute. Liability company LLC that is treated as a C or S corporation. A W-9 form is necessary because it allows you to collect.

If youre unsure its always best to file a 1099-NEC. Contractors may sometimes check the incorrect box on their W-9 or fail to file in time. From IRSs 1099-Misc instructions.

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. Payments of rent to real estate agents or property managers. The following payments made to corporations generally must be reported on Form 1099-MISC.

If you see its taxed as an S Corp or C Corp it does not need to receive a 1099-MISC or 1099-NEC. Exceptions to the 1099 Rules There are some exceptions to the general rules. A Limited Liability Company LLC is an entity created by state statute.

This is only required if you performed over 600 worth of. For LLCs taxed as either sole proprietors or partnerships youll need to receive a 1099-MISC from your clients. If your company isnt sure if a contractor should receive a 1099.

Even though an LLC can file an election with the IRS to be taxed like a corporation your business may not be aware of the LLCs current tax status so its usually safer to issue a 1099 to any LLC that you pay more than 600 on an annual basis. Most corporations dont get 1099-MISCs Another important point to note. You should still send a 1099-MISC to a single-member limited liability company or a one-person limited corporation Ltd but not an LLC that has elected S corporation or C corporation status.

If the person has a single member LLC and is taxed as a corporation then you do not have to issue the LLC a 1099 MISC. What if You File a 1099 for an LLC that Doesnt Require One. Exception to the general rule.

As a general rule a business is not required to issue a 1099 to a corporation or other entity taxed as a corporation. For tax purposes theyre treated as corporations so in general they dont get a 1099. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

An LLC will not receive a 1099 if taxed as an s-corporation. You do need to issue the LLC a 1099 MISC. When your total rent payments require a 1099-MISC you will first need to request a W-9 form from the LLC that leases the property to you.

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

201 Llc Vs S Corp 3 Drawbacks Of An S Corporation Costs And Problems Youtube Llc Business S Corporation Business Finance

201 Llc Vs S Corp 3 Drawbacks Of An S Corporation Costs And Problems Youtube Llc Business S Corporation Business Finance

S Corp Vs Llc Tax Benefits Llc Taxes Financial Independence Retire Early Business Tax

S Corp Vs Llc Tax Benefits Llc Taxes Financial Independence Retire Early Business Tax

Sole Proprietor Partnership Llc S Corp What Does It All Mean I Will Break It Down And Show The Business Entity Sole Proprietor Business Creative Business

Sole Proprietor Partnership Llc S Corp What Does It All Mean I Will Break It Down And Show The Business Entity Sole Proprietor Business Creative Business

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

To Get Started On Your Taxes But Not Your Stress Use These Helpful Tax Information You Will Need At Your Fingertips F Tax Season Tax Prep Checklist Tax Refund

To Get Started On Your Taxes But Not Your Stress Use These Helpful Tax Information You Will Need At Your Fingertips F Tax Season Tax Prep Checklist Tax Refund

Turbotax Business 2018 Tax Software Pc Download Tax Software Turbotax Software

Turbotax Business 2018 Tax Software Pc Download Tax Software Turbotax Software

201 Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Yo Llc Taxes Financial Literacy Budgeting Finances

201 Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Yo Llc Taxes Financial Literacy Budgeting Finances

Llc Vs S Corp What S The Difference Truic

Llc Vs S Corp What S The Difference Truic

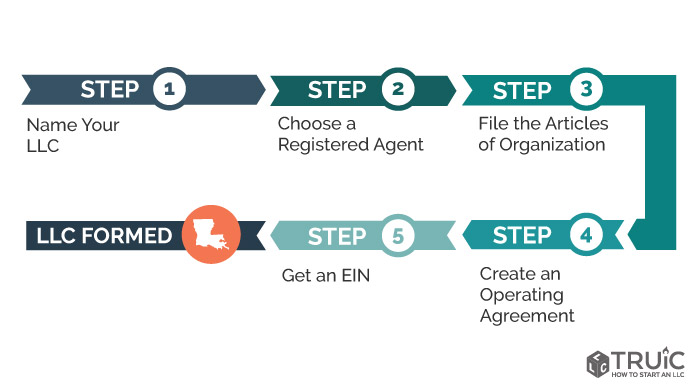

Llc Louisiana How To Get An Llc In Louisiana Truic Guides

Llc Louisiana How To Get An Llc In Louisiana Truic Guides

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Llc Vs S Corp A Step By Step Guide For Choosing The Best Small Business Entity Careful Cents Budgeting Finances Business Budgeting

Llc Vs S Corp A Step By Step Guide For Choosing The Best Small Business Entity Careful Cents Budgeting Finances Business Budgeting

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

So Many Creative Entrepreneurs Are Often Confused When It Comes To The 1099 Or W 9 I Will Show You Wh Bookkeeping Software Business Blog Woman Business Owner

So Many Creative Entrepreneurs Are Often Confused When It Comes To The 1099 Or W 9 I Will Show You Wh Bookkeeping Software Business Blog Woman Business Owner

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic