Which Itr Form To Fill For Housewife

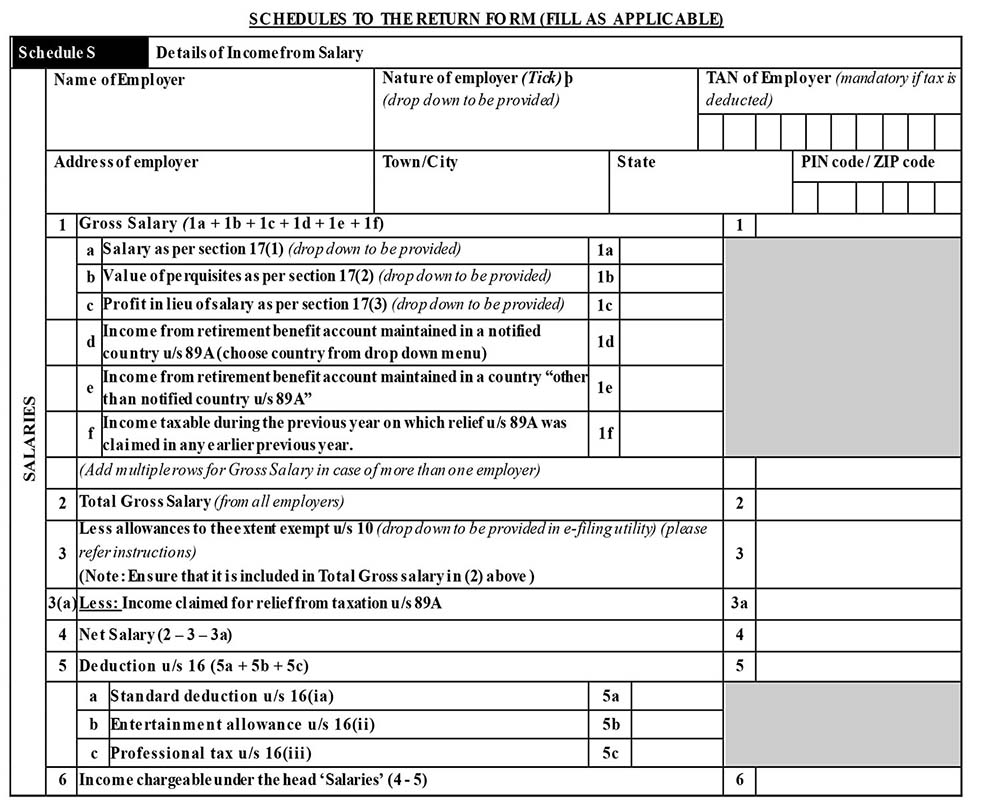

File her AY 2017-18 ITR and show income from other sources upto 270000 tax is nil thus show amount below such amount and file ITR if in future any income tax notice receive chances to receive notice is less then 10 then we can show income proof as last year income and other accumulated savings over the. If your wife has a business income or any professional income suppose your wife is a doctor or lawyer in this case your wife should file a return in form ITR-4.

How To Complete Part 6 On The Form I 864 Sponsor S Employment And Income Sound Immigration

How To Complete Part 6 On The Form I 864 Sponsor S Employment And Income Sound Immigration

This form is form those who have an annual income of fewer than 50 lakhs.

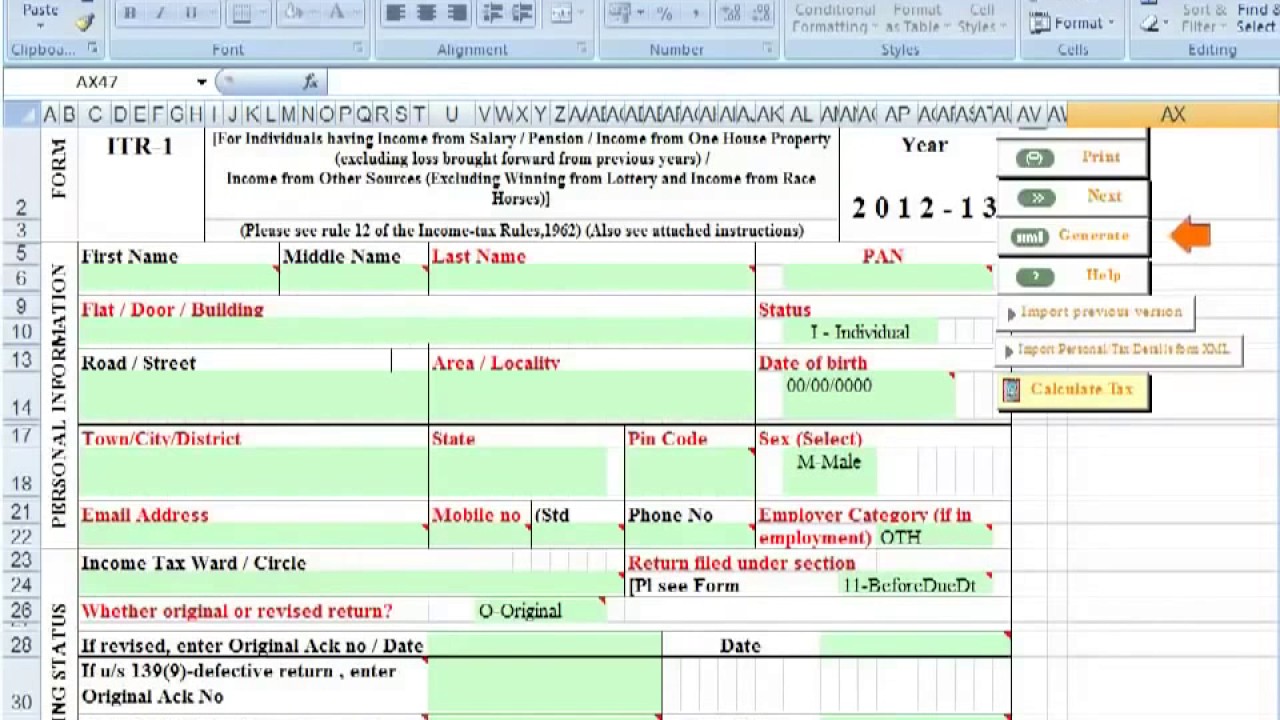

Which itr form to fill for housewife. I am agree with aaditya. It is important to file your tax return using the correct ITR form. If the tax return is filed not using the correct form then the ITR will be termed as defective return and you will be asked to file.

In case if the gift is received from other than the relatives there is a limit of Rs 50000 beyond that will be included with the part of the total income. CBDT notifies Form Sahaj ITR-1 Form ITR-2 Form ITR-3 Form Sugam ITR-4 Form ITR-5 Form ITR-6 Form ITR-7 and Form ITR-V for Assessment Year 2020-21 i ITR Income Tax Return Forms 1 to 7 for AY 2020-21 notified. Does a housewife need to file ITR for the money.

The income that you earn by investing this money will be clubbed with your husbands taxable income. You can have the income from the house property and other sources except the amount finning from the lottery and from the winning of the racehorses. SARAL - II ITR - 1 can be used.

You can write their that amount which she is earning like interest on bank deposits tuition income. Remember to file it before 31st July 2018 and dont forget to claim deduction under vari. While Compiling the gift and total income exceeds the prescribed limit then the housewife has to pay the tax and must file the ITR.

If your wife only earns income through tuition it is better and easier to fill ITR1 for AY 201819 and disclos tuition income in Income from Other Sources. Why housewives should file ITR If you are a homemaker and do not earn anything on your own you may think you do not need to file income tax return ITR. As you are aware of the fact that all the Income Tax Return forms have a different purpose and different taxpayers are supposed to e-file the different ITR forms based on their income source of income and the type of taxpayer.

Archit Gupta CEO ClearTax says You are not required to file income tax return or pay tax on the money you receive from your spouse. Here the housewife is not necessary to file the ITR. And if you only want to file ITR then you can file ITR-1 in which 5 HEAD Income from other sources.

Saral-2 ITR-1 can be filled by the persn having income from Salary House Property interest from Bank. ITR 1 Form is filed by the taxpayers and the individuals who are a Resident with the total Income up to INR 50 lakhs when the Income is from Salaries One House Property Other Sources Interest dividend etc and. The income tax return forms have been notified by the Central Board of Direct Taxes CBDT.

Know which ITR Form to fill this assessment year. No need to file ITR for the house wife if she is not earning any money. ITR2 form is supposed to submit by the taxpayers whose income is above Rs.

However the basic limit for AY 2018-19 for individuals is Rs. All Instruction sheets for filling of income tax return forms such as ITR-2356 7 updated on the portal. It can used if u have salary income or income from house property however u should not have more than one house and if u have interest income.

You have to choose ITR-1 Form which is also known as Sahaj Form if you are a salaried employee. Trending in TaxHow to file ITR Form 16 validity. ITR Form number to file depends on your Income Source Residential Status and other financial situation.

250000- net income there is no any tax and after from 250000- to 500000- there is only 5 tax on income.

How To File Itr For Housewife In 2020 Ay 2020 21 Step By Step Income Tax Return Process Hindi Youtube

How To File Itr For Housewife In 2020 Ay 2020 21 Step By Step Income Tax Return Process Hindi Youtube

Types Of Itr Forms Find Which Form Is For You And How To Fill It Business News Times Of India

Types Of Itr Forms Find Which Form Is For You And How To Fill It Business News Times Of India

Itr 2 Filing What Is Itr2 How To File Itr 2 Form India Business News Times Of India

Itr 2 Filing What Is Itr2 How To File Itr 2 Form India Business News Times Of India

Which Itr Form Should Be Filed For A House Wife Quora

How To File Return For Housewife Having Saving And Fd Interest Ay 2018 19 Step By Step Youtube

How To File Return For Housewife Having Saving And Fd Interest Ay 2018 19 Step By Step Youtube

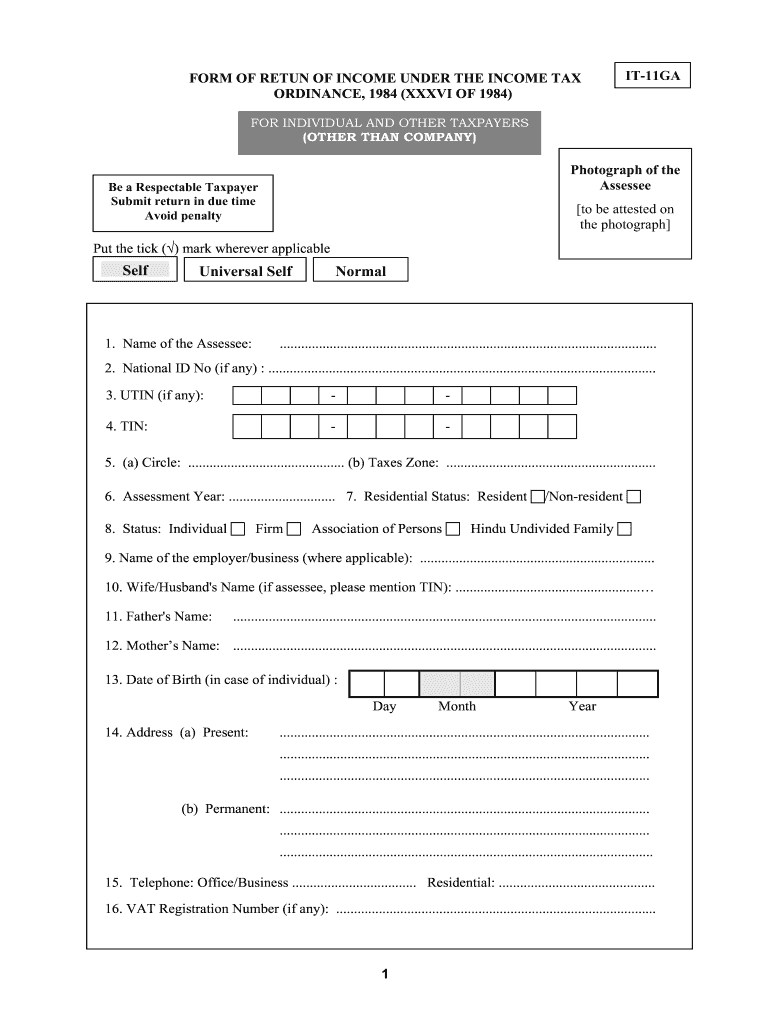

Tax Return Form Fill Online Printable Fillable Blank Pdffiller

Tax Return Form Fill Online Printable Fillable Blank Pdffiller

You May Have To File Itr This Year Even If Your Income Is Below Taxable Limit

You May Have To File Itr This Year Even If Your Income Is Below Taxable Limit

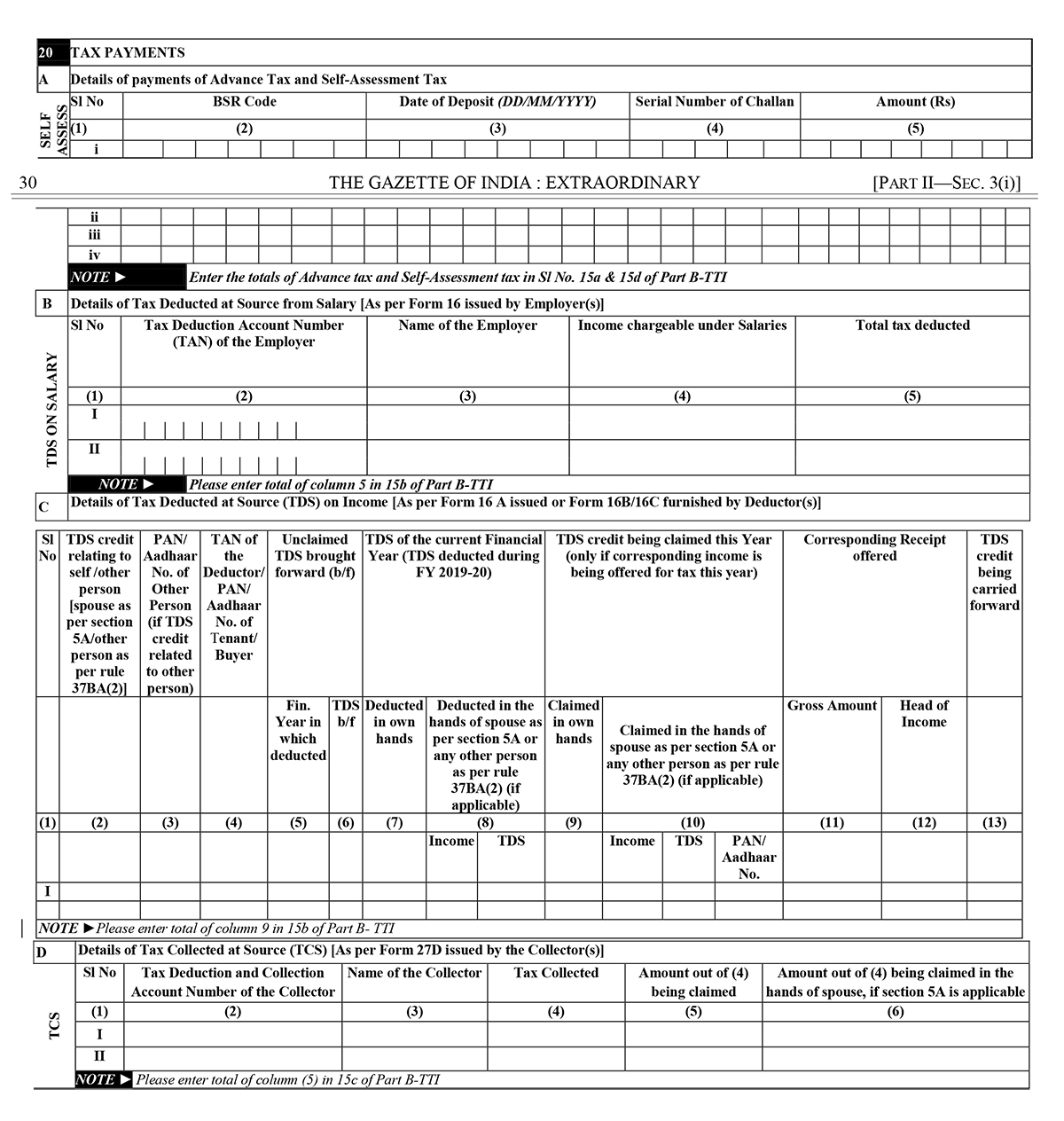

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Housewives With No Income Should Also File It Return Here S Why

Housewives With No Income Should Also File It Return Here S Why

Income Tax Return For Ay 2020 21 Who Can File Itr1 Documents Checklist

Income Tax Return For Ay 2020 21 Who Can File Itr1 Documents Checklist

Itr 1 Sahaj Itr 4 Sugam For Ay 2020 21 Notified What Has Changed In Itr Forms

Itr 1 Sahaj Itr 4 Sugam For Ay 2020 21 Notified What Has Changed In Itr Forms

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Free Step By Step Guide For E Filing Income Tax Return Itr Online India Youtube

Free Step By Step Guide For E Filing Income Tax Return Itr Online India Youtube

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

Step By Step Guide To File Itr 2 Online Ay 2020 21 Full Procedure

How To File Income Tax Return Ay 2019 20 With Form 16 For Salaried Persons Other Income Itr 1 Youtube

How To File Income Tax Return Ay 2019 20 With Form 16 For Salaried Persons Other Income Itr 1 Youtube

Going To File Your Income Tax Return Know Which Itr Form To Use The Financial Express

Going To File Your Income Tax Return Know Which Itr Form To Use The Financial Express