Business Travel Mileage Rate 2019

575 cents per mile for business was 58 cents in 2019 17 cents per mile for medical was 20 cents in 2018 14 cents per mile for charity no change. Theyre identical to the rates that applied during 2018-19.

Irs Announces 2019 Business Mileage Rate Of 58 Cents Per Mile Powered By Motus Cost Data And Analysis

Irs Announces 2019 Business Mileage Rate Of 58 Cents Per Mile Powered By Motus Cost Data And Analysis

The rates for 2021 will be available on our website in 2022If you are an employer go to Automobile and motor vehicle allowances.

Business travel mileage rate 2019. The rates apply for any business journeys you make between 6 April 2019 and 5 April 2020. Did not have many miles in 2019 for two months. Updated 4 July 2019 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments - cars and vans 5p per passenger per business mile for carrying fellow employees in a car or.

Starting January 1 2019 the standard mileage rates for the use of a car including vans pickups or panel trucks will be. 58 cents per mile driven for business use up 35 cents from the rate for 2018 20 cents per mile driven for medical or moving purposes up 2 cents from the rate for 2018 and. The IRS annually issues guidance providing updated per diem rates.

See section 404 of Rev. The Tier Two rate is for running. 58 cents per mile driven for business use up 35 cents from the rate for 2018 20 cents per mile driven for medical or moving purposes up 2 cents from the rate for 2018 and.

So only a few months of my 2019 tax return the car I used mileage. For 2020 the standard mileage rates are. Publication 463 Travel Gift and Car Expenses PDF.

14 cents per mile driven in service of charitable organizations. Notice 2019-55 PDF provides the rates that have been in effect since October 1 2019. For a motorcycle this is 028 and for a bike it is 038.

14 rows The following table summarizes the optional standard mileage rates for employees self. The Austrian rate for mileage reimbursement is 042 per km for a car. Use HMRC s MAPs working sheet if you need help.

1 2019 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. To calculate the approved amount multiply your employees business travel miles for the year by the rate per mile for their vehicle. This includes private use travel.

For automobiles a taxpayer uses for business purposes the portion of the business standard mileage rate treated as depreciation is 24 cents per mile for 2015 24 cents per mile for 2016 25 cents per mile for 2017 25 cents per mile for 2018 and 26 cents per mile for 2019. Publication 535 Business Expenses PDF. Meal and vehicle rates for previous years are also available.

Kilometre rates for the 2018-2019 income year. In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile. Rates per kilometRe.

Rates per kilometre which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed are determined using the table published on this website under Legal Counsel Secondary Legislation Income Tax Notices Fixing of rate per kilometre in respect of motor vehicles. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and 14 cents per mile driven in service of charitable organizations. The HMRC AMAP rates for 2019-20 are in.

Use the Tier One rate for the business portion of the first 14000 kilometres travelled by the vehicle in a year. 14 cents per mile driven in service of charitable organizations. The Tier One rate is a combination of your vehicles fixed and running costs.

I am assuming I used mileage rate. My old car 2007 Accord was using mileage for all those years. A u s t r i a.

The official mileage allowance can be recognized for a maximum of 30000 kilometers per calendar year. The car was purchased on October 19th of 2019. I had a lot more miles in my 2019 return on my 2007 Accord.

The following applies to the 2020 tax year. Using the Tier One and Tier Two rates. Personal Vehicle Standard Rate.

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

2019 Volunteer Mileage Rates And Irs Reimbursement Guidelines

Policy Considerations For Mileage Reimbursement I T E I Fyle

Policy Considerations For Mileage Reimbursement I T E I Fyle

What You Need To Know About Publication 463 And Business Travel

What You Need To Know About Publication 463 And Business Travel

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

What Is The 2020 Standard Mileage Rate And How Do I Use It In My Business

What Is The 2020 Standard Mileage Rate And How Do I Use It In My Business

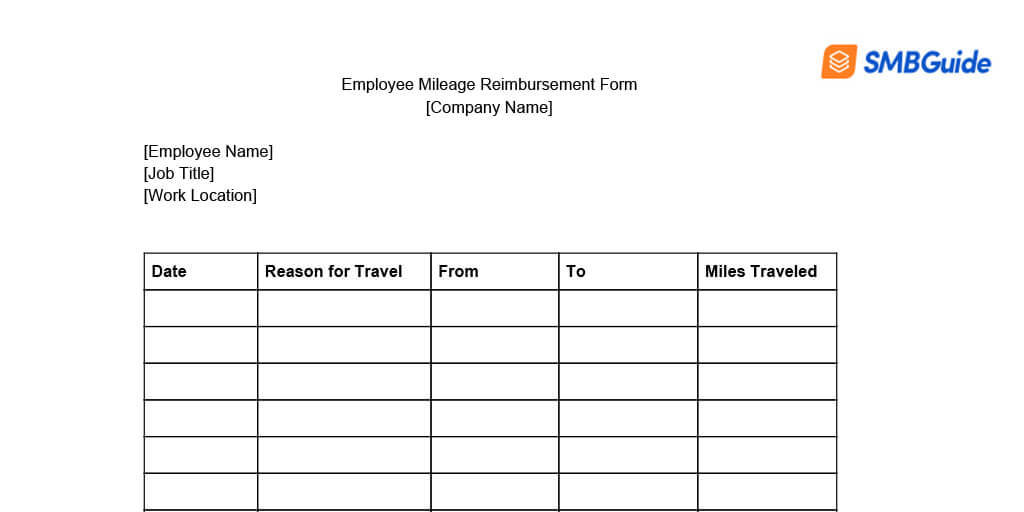

Mileage Reimbursement For Employees Info Free Download

Mileage Reimbursement For Employees Info Free Download

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Your Guide To 2020 Irs Mileage Rate I T E Policy I

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

2019 Standard Mileage Rates For Food Trucks Mobile Cuisine

2019 Standard Mileage Rates For Food Trucks Mobile Cuisine

Mileage Reimbursements Revisited Again September 2019 Tax Alert Deloitte New Zealand

Mileage Reimbursements Revisited Again September 2019 Tax Alert Deloitte New Zealand

Irs Announces 2019 Mileage Rates

Irs Announces 2019 Mileage Rates

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Irs Releases Standard Mileage Rates For 2020 Holland Company

Irs Releases Standard Mileage Rates For 2020 Holland Company

Mileage Rates 2019 Irs Mileage Deduction Mileage

Mileage Rates 2019 Irs Mileage Deduction Mileage