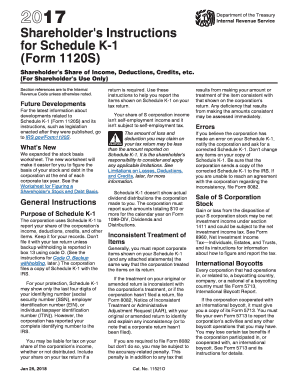

2015 Form 1120s K-1 Instructions

For details see the Instructions for Form 2553. MO-1120S if they file Federal Form 1120S and the S corporation has.

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Tax information is available on the DRS website at.

2015 form 1120s k-1 instructions. Schedule K-1 Form 1120S. Enter the taxpayers apportioned amount of Miscellaneous Income from. 23 rows Final K-1.

20 00 21 Other additions. Form 1120S for more information about the At-Risk Limitation. Schedule K-1 100S Instructions 2015 Page 1 2015 Shareholders Instructions for Schedule K-1 100S For S Corporation Shareholders Use Only References in these instructions are to the Internal Revenue Code IRC as of.

2015 1120S K 1. See Form 8996 and the Instructions for Form 8996. The way to complete the IRS Instruction 1120S - Schedule K-1 online.

Form CT-1065 CT-1120SI Form CT-1065 CT-1120SI EXT Schedule CT K-1 Form CT K-1T Form CT-1065 CT-1120SI Supplemental Attachment 2015 FORM CT-1065 CT-1120SI More Department of Revenue Services DRS tax information is listed on the back cover. See the Schedule K-1-P1 and the Schedule B instructions for more information. Corporations may qualify for a credit for wages paid in tax years beginning after 2017 to qualifying employees on family and medical leave.

2015 This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders who file Form 1040. Income -Select My Forms. 201 rows 2015 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits.

Information about Form 1120S and its separate instructions is at wwwirsgovform1120s. Box 17 code U is used to report information. For detailed reporting and filing information see the separate Shareholders Instructions for Schedule K-1 and the instructions for your income tax return.

Schedule K-1 Form 1120S you receive should only reflect your share of income deductions and expenses as applicable. 22 00 Step 5. Attach Schedules K-1-P or K-1-T.

Federal Form 1120S Schedule K lines 2 3c and 6 or Federal Form 1065 Schedule K lines 2 3c and 7. 1 a shareholder that is a Missouri resident. Schedule K-1-P3 has been developed to assist you in calculating pass-through withholding.

This amount is your income or loss. Form 8996 may be required. Fill all needed fields in your file with our powerful PDF editor.

Ensure the correctness of added details. Attach Illinois Schedule M for businesses. Then each shareholders share of the profit or loss of the corporation is recorded on a Schedule K-1.

Reminders Election by a small business corpo ration. Also see Form 8994 and. Fill out securely sign print or email your 2015-2020 k 1 form instantly with SignNow.

Dont file Form 1120S unless the corporation has filed or is attaching Form 2553 Election by a Small Business Corporation. 2015 K-1 Instructions_Layout 1 Author. Schedule K-1 Form 1120S Department of the.

Department of the Treasury Internal Revenue Service 2011 Instructions for Form 1120S. 2015 Shareholders Share of Income Deductions Credits etc. 21 00 22 Add Lines 14 through 21.

Available for PC iOS and Android. Form 1120S Department of the Treasury Internal Revenue Service US. Amended K-1 OMB No.

Click the button Get Form to open it and begin editing. Page 1 of 42 Instructions for Form 1120S 1333 - 31-JAN-2012 The type and rule above prints on all proofs including departmental reproduction proofs. Also see Form 1120 Schedule K Question 25.

Form 1120-S Schedule K-1 - Shareholders Share of Income Deductions Credits etc. Schedule K-1 Form 1120S 2015 Page 2 This list identifies the codes used on Schedule K-1 for all shareholders and provides summarized reporting information for shareholders who file Form 1040. Include the date of submitting IRS Instruction 1120S - Schedule K-1.

Switch the Wizard Tool on to complete the procedure even simpler. 1252015 100759 AM. CALIFORNIA SCHEDULE K-1 100S 7871153 For use by an S corporation and its shareholders only.

Schedule K-1 Form 1120S - Shareholders Share of Income. Instructions for Schedule D Form 1120S. The K-1 information for each shareholder is reported on Line 17 of the shareholders Form 1040.

If you received a Schedule K-1 Form 1120S as a shareholder to make the entry go to. 19 00 20 The amount of loss distributable to a shareholder subject to replacement tax. Start a free trial now to save yourself time and money.

Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to elect to be an S corporation. You are required to complete and keep a copy of Schedule K-1-P3 for each of your nonresident members who have not submitted Form IL-1000-E to you. Figure your base income or loss.

Qualified subchapter S subsidiaries QSSS must file a separate Form MO-1120S and attach. MUST be removed before printing. For detailed reporting and filing information see the separate Shareholders Instructions for Schedule K-1 and the instructions for your income tax return.

First the corporation files a corporate tax return on Form 1120-S. Or 2 any income derived from Missouri sources Section 143471 RSMo. Return and Instructions This booklet contains.

Schedule K1 Form 1120S. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Credit for paid family and medical leave.

Attach a copy of Federal Form 1120S and all Schedule K-1s. For calendar year 2015 or fiscal year beginning m m d d y y y y and ending m m d d y y y y Shareholders name Shareholders identifying number.

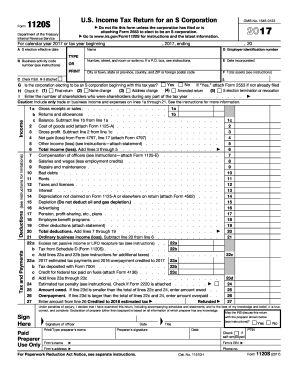

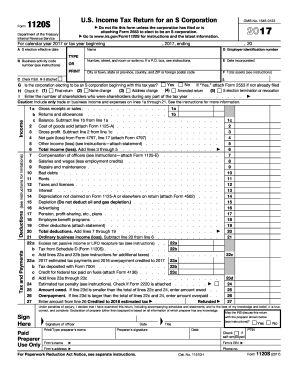

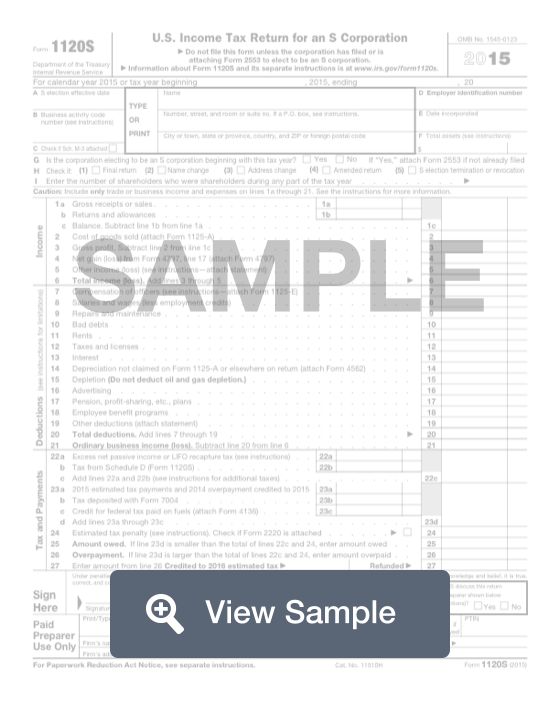

Premiuminc Form 1120s U S Income Tax Return For An S Corporation Omb No 1545 0123 Do Not File This Form Unless The Corporation Has Filed Or Is Course Hero

Premiuminc Form 1120s U S Income Tax Return For An S Corporation Omb No 1545 0123 Do Not File This Form Unless The Corporation Has Filed Or Is Course Hero

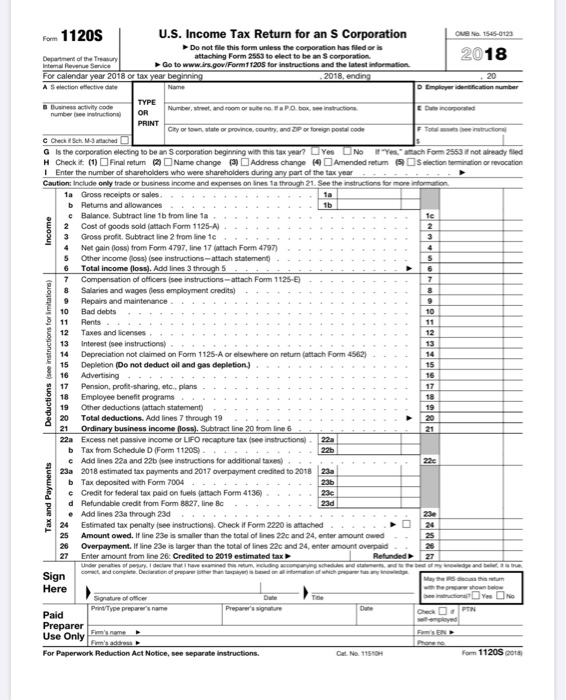

Drafts Of 2019 Forms 1065 And 1120s As Well As K 1s Issued By Irs Current Federal Tax Developments

Drafts Of 2019 Forms 1065 And 1120s As Well As K 1s Issued By Irs Current Federal Tax Developments

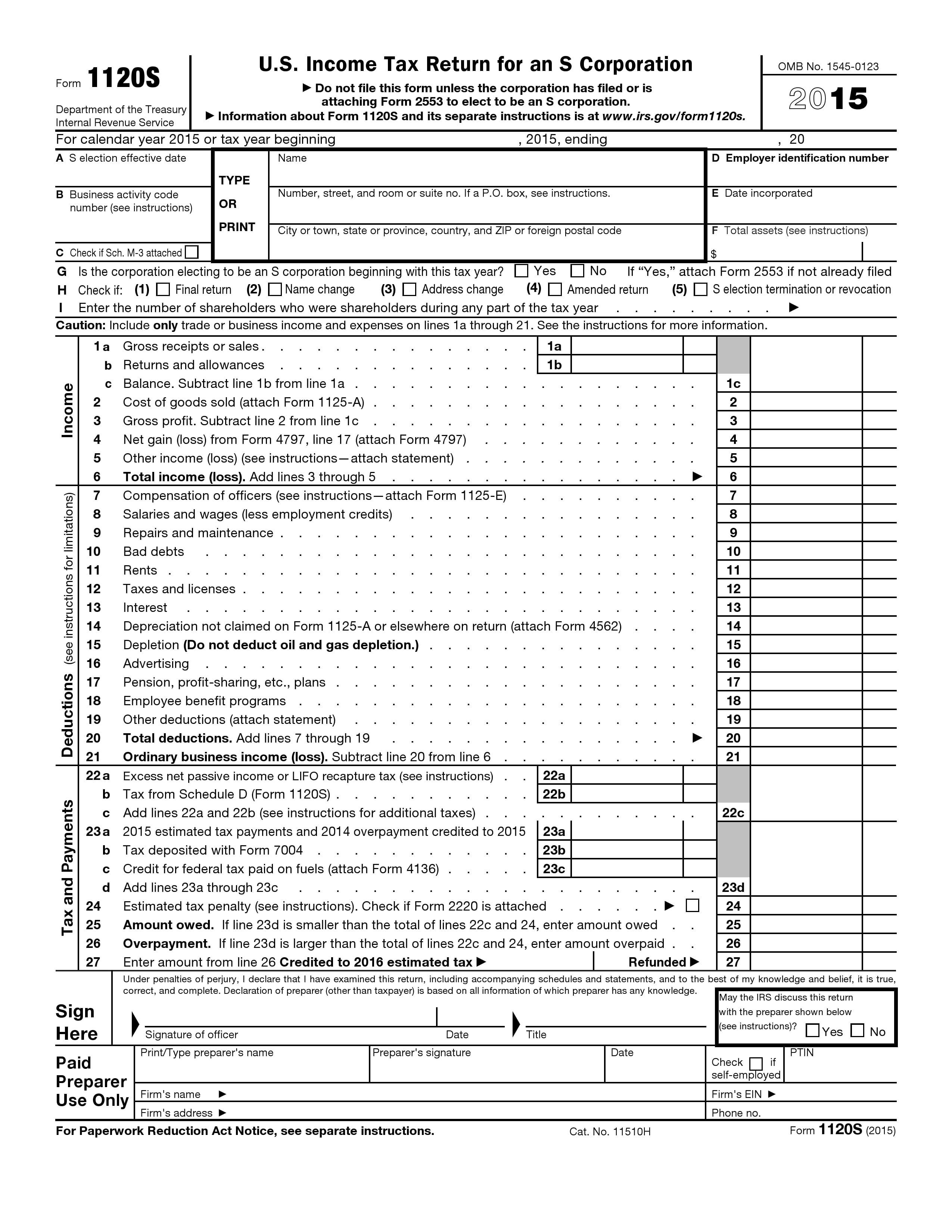

Free U S Income Tax Return For An S Corporation Form 1120s Pdf Template Form Download

Free U S Income Tax Return For An S Corporation Form 1120s Pdf Template Form Download

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Solved The Following Information Is Necessary To Complete Chegg Com

Solved The Following Information Is Necessary To Complete Chegg Com

1120s Fill Out And Sign Printable Pdf Template Signnow

1120s Fill Out And Sign Printable Pdf Template Signnow

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Schedule K 1 Form 1120s 2016 Lovely Free Fillable 1099 Misc Form 2018 Free Tax Forms 2016 Irs 2017 U S Models Form Ideas

Schedule K 1 Form 1120s 2016 Lovely Free Fillable 1099 Misc Form 2018 Free Tax Forms 2016 Irs 2017 U S Models Form Ideas

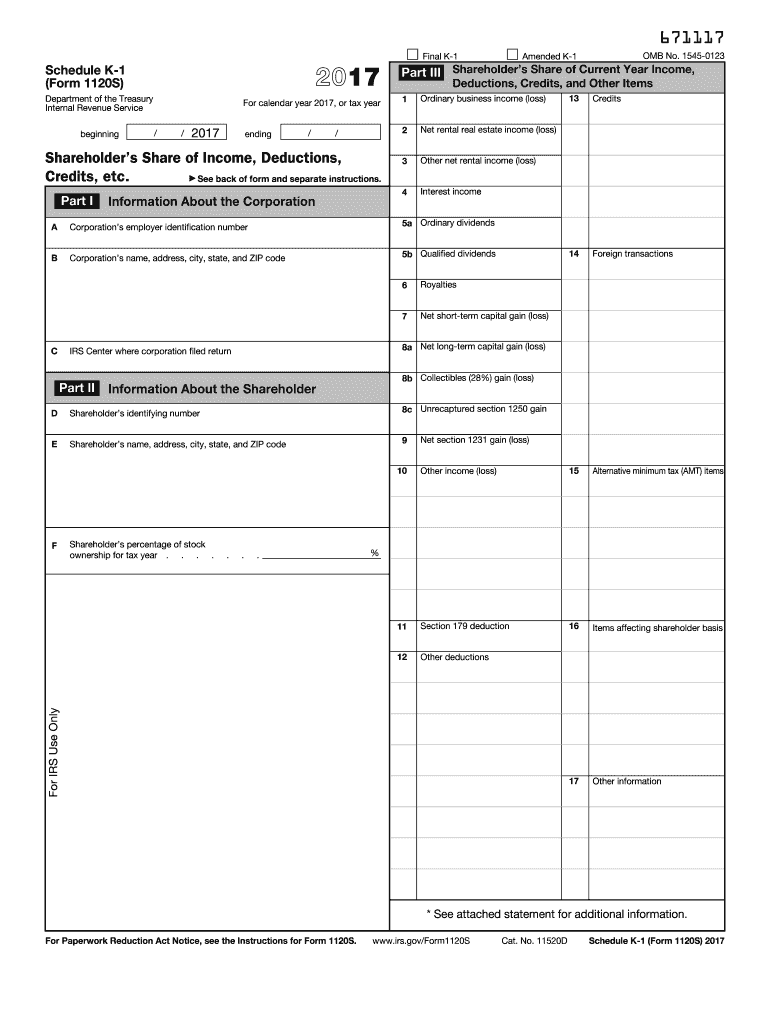

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

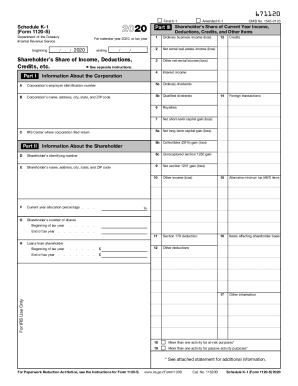

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Dropbox5 3 1 Pdf Form 1120s Department Of The Treasury Internal Revenue Service U S Income Tax Return For An S Corporation Omb No 1545 0123 Do Not Course Hero

Dropbox5 3 1 Pdf Form 1120s Department Of The Treasury Internal Revenue Service U S Income Tax Return For An S Corporation Omb No 1545 0123 Do Not Course Hero

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Fillable Online Irs Schedule K 1 Form 1120s 2016 Fax Email Print Pdffiller

Fillable Online Irs Schedule K 1 Form 1120s 2016 Fax Email Print Pdffiller

1120s K 1 Codes Fill Online Printable Fillable Blank Pdffiller

1120s K 1 Codes Fill Online Printable Fillable Blank Pdffiller

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Form 1120s S Corporation Tax Return Fill Out Online Pdf Formswift

Form 1120s S Corporation Tax Return Fill Out Online Pdf Formswift

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

2015 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2015 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller