What Expenses Can I Claim As A Self Employed Driver

Vehicle repair and servicing costs. As a self-employed worker tax deductions for business expenses are the best way to prepare an accurate tax return and lower your taxes.

H And R Block Clarkesville Ga Georgia Corneliaga Shoplocal Localga Cornelia Georgia Income Tax Preparation Tax Preparation Tax Rules

H And R Block Clarkesville Ga Georgia Corneliaga Shoplocal Localga Cornelia Georgia Income Tax Preparation Tax Preparation Tax Rules

Jan 25 2020 Expenses that are not part of the normal operation of your vehicle are claimable.

What expenses can i claim as a self employed driver. Feb 16 2017 Whether youre a courier for Postmates Amazon Flex DoorDash or any other delivery service youve got business expenses that you can deduct from your delivery income. May 25 2019 Driver. Self-employed individuals can deduct their non-commuting business mileage.

Your biggest tax deductions will be costs related to. Mobile phone phone holder. There are two methods for figuring car expenses.

Couriers may be able to claim. The cost of washing or cleaning your own vehicle. For 2020 tax returns you can use the standard mileage rate to take a deduction of 0575 per business mile.

Interest on any bank or personal loans taken out to purchase your vehicle. Mar 05 2021 As a rideshare driver you can claim a tax deduction for the miles you drive on the job. Bike maintenance such as brake pads tyre replacement.

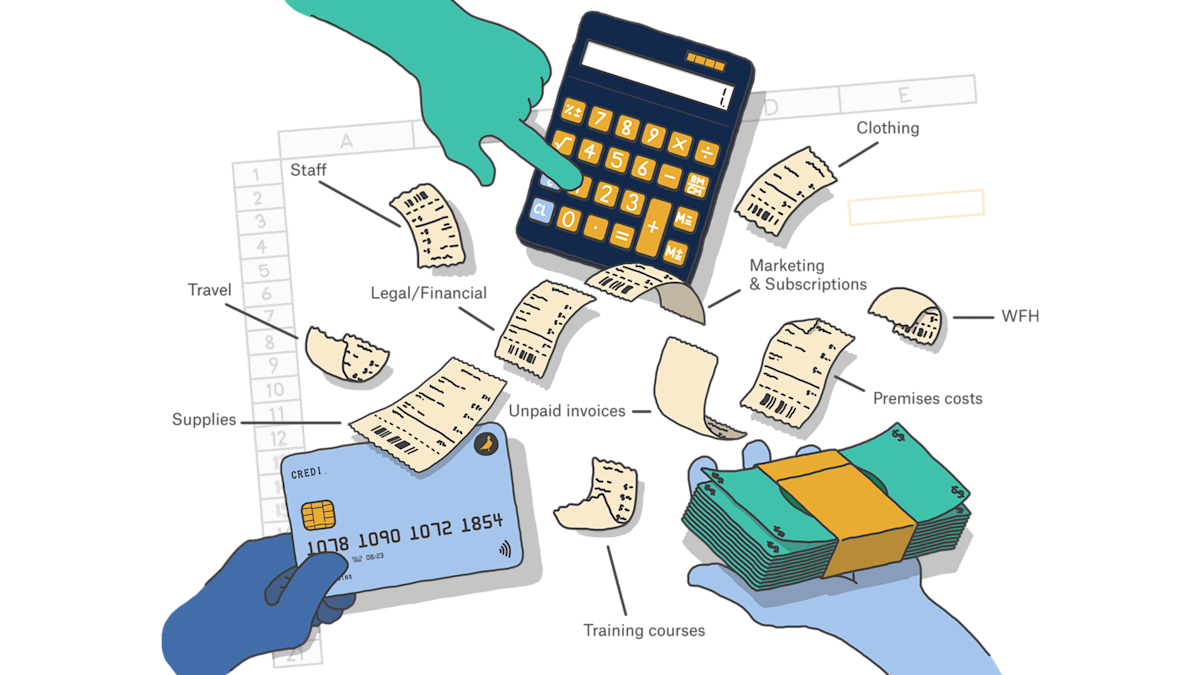

As a self-employed individual there are certain essential business costs which arent taxable by HMRC. If a taxpayer uses the car for both business and personal purposes the expenses must be split. Sep 13 2017 Claiming for allowable business expenses is the easiest way to reduce your uber taxes when youre self-employed.

Train bus air and taxi fares. Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Vehicle insurance and AARAC membership are both eligible expenses as well.

However local truck drivers typically cannot deduct travel expenses. Your license and any other registration fees. Typically most of the things that you pay for as a driver will be tax-deductible for example.

Interest on any bank or personal loans taken out to purchase your vehicle. Your license and any other registration fees. The costs of your annual road tax and your MOT test.

You can also claim for any registration fees you have been subject to for example license fees. You can claim your business phone and data costs equipment and supplies and all other direct business expenses. Interest on any loans taken out to pay for.

If you use the actual expense method to calculate the deduction youll add up all your vehicle-related costs and deduct a certain percent of the total. Parking charges fines are not allowed. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return.

Car purchase see below. The deduction is based on the portion of mileage used for business. Feb 01 2018 If you purchased your tax using a personal loan or a bank loan you can state the interest on the loan as an expense.

Jun 14 2017 Answer. The costs of your annual road tax and your MOT test. If you use the standard mileage rate youll deduct 0575 per mile driven for business.

Office and admin expenses. Bank charges for. The IRS considers a semi-truck to be a qualified non-personal-use vehicle.

You can deduct common driving expenses including fees and tolls that Uber and Lyft take out of your pay. There are also some car-related costs that still can be claimed when taking the mileage deduction. Here are a few that Stride wants all delivery drivers to know about.

Alternately you can use the actual expense method to deduct the business portion of costs like gas repairs and maintenance auto insurance registration and car loan interest or. Car wash cleaning and detailing. Mileage daily meal allowances truck repair maintenance overnight hotel expenses and union dues are some of the tax deductions available.

Mobile phones data plans and mobile phone accessories chargers cradles and mounts Vehicle expenses or standard mileage. Truck drivers who are independent contractors can claim a variety of tax deductions while on the road. Taxes and deductions that may be considered ordinary and necessary depends upon.

You can claim allowable business expenses for. As an Uber Lyft or other self-employed driver you can deduct these work-related expenses in addition to the ones listed above. Deliveroo commissions and service charges.

The cost of washing or cleaning your own vehicle.

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Studio Waterstone Keeping Track Of Expenses Scentsy Business Jamberry Business Business Expense

Studio Waterstone Keeping Track Of Expenses Scentsy Business Jamberry Business Business Expense

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

How Much Rideshare Drivers Actually Make In A Year The Bold Italic San Francisco Uber Driving Uber Driver Rideshare Driver

How Much Rideshare Drivers Actually Make In A Year The Bold Italic San Francisco Uber Driving Uber Driver Rideshare Driver

.svg)

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan Tax Services How To Plan Business

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan Tax Services How To Plan Business

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

6 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Business Expenses For Doordash Instacart Instacart Uber Eats Taxes

Taxes For Turkers Reporting Self Employment Income Mturk Crowd Mechanical Turk Community Forum Self Employment Income Employment

Taxes For Turkers Reporting Self Employment Income Mturk Crowd Mechanical Turk Community Forum Self Employment Income Employment

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Home Office Deduction Worksheet Excel

Home Office Deduction Worksheet Excel

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Diy In 123 Steps In How To Organize Receipts For Tax Season Receipt Organization Diy Taxes Tax Organization

Diy In 123 Steps In How To Organize Receipts For Tax Season Receipt Organization Diy Taxes Tax Organization

Self Employed Tax Preparation Printables Instant Download Etsy In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

Self Employed Tax Preparation Printables Instant Download Etsy In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

Tax Deductions For Your Online Business Expenses

Tax Deductions For Your Online Business Expenses

Freelancer S Guide To Car Tax Deductions

Freelancer S Guide To Car Tax Deductions