How To Calculate Future Maintainable Profit

And c adjustments of preferred rights. Goodwill Future maintainable profit after tax x No.

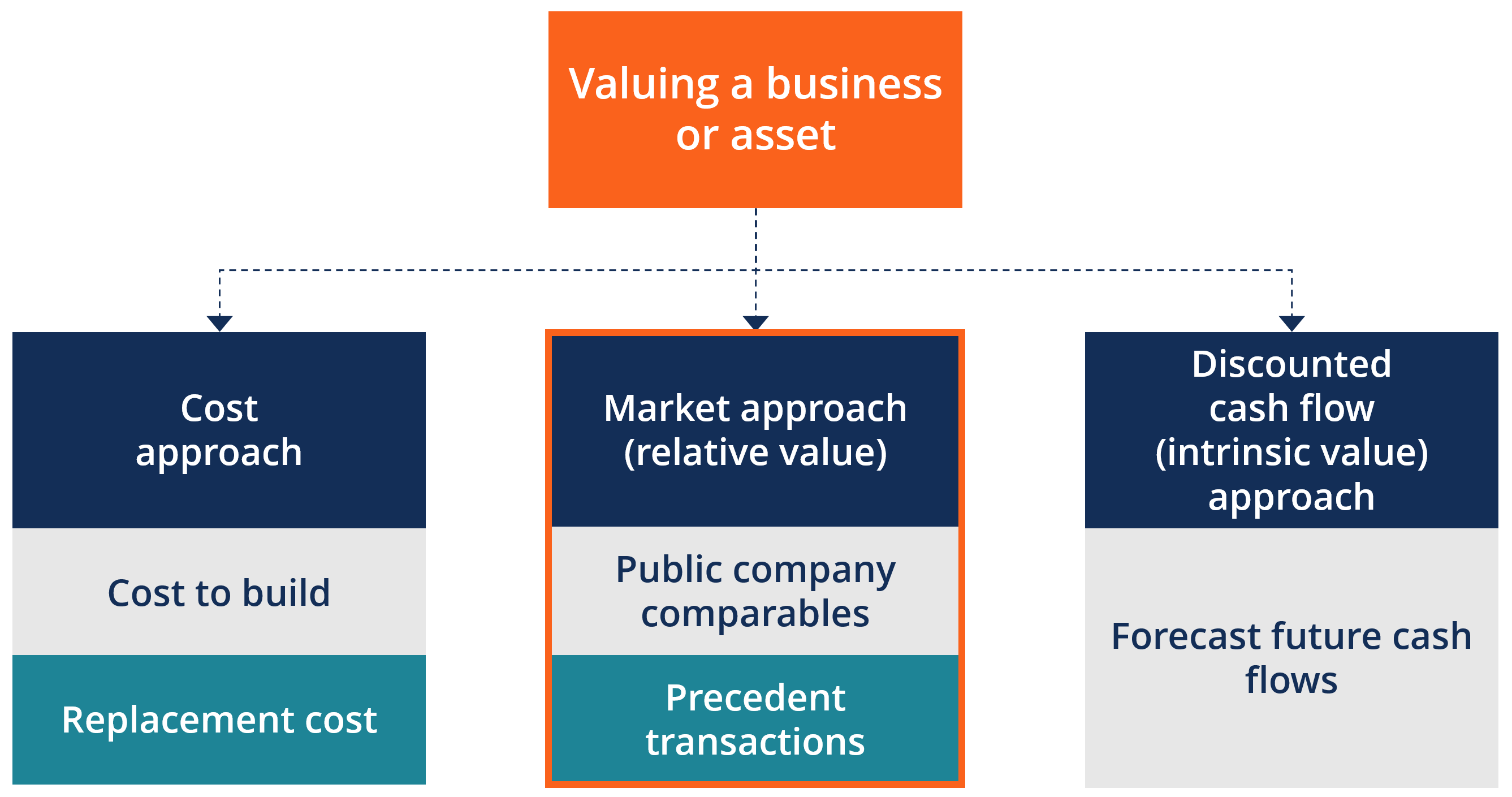

Market Approach Methods Uses Advantages And Disadvantages

Market Approach Methods Uses Advantages And Disadvantages

Fluctuation in the value of trade investments is uncertain nature.

How to calculate future maintainable profit. Simple average profits are taken as Future Maintainable profits when fluctuations in the profits are not very large. Profit means different things to different people. B projection of the future maintainable taxed profits.

Future maintainable earnings and capitalise those earnings for an expected rate of return for the investment. Super profit is the excess of estimated future profits over average profits. Valuation working paper capitalisation method.

Value Future Maintainable Earnings Capitalisation Rate - Net Surplus Assets if any. Those items only we should consider. Valuer has to take in to consideration the Average Adjusted Past Profit various economic factor which has got crucial impact on the concern.

In order to calculate the past average earnings it is necessary to decide upon the number of years whose results should be taken. You should make sure either you are talking about the total owners income or income after all the wages salary and other expenses. Super Profit Average maintainable profits Normal Profits.

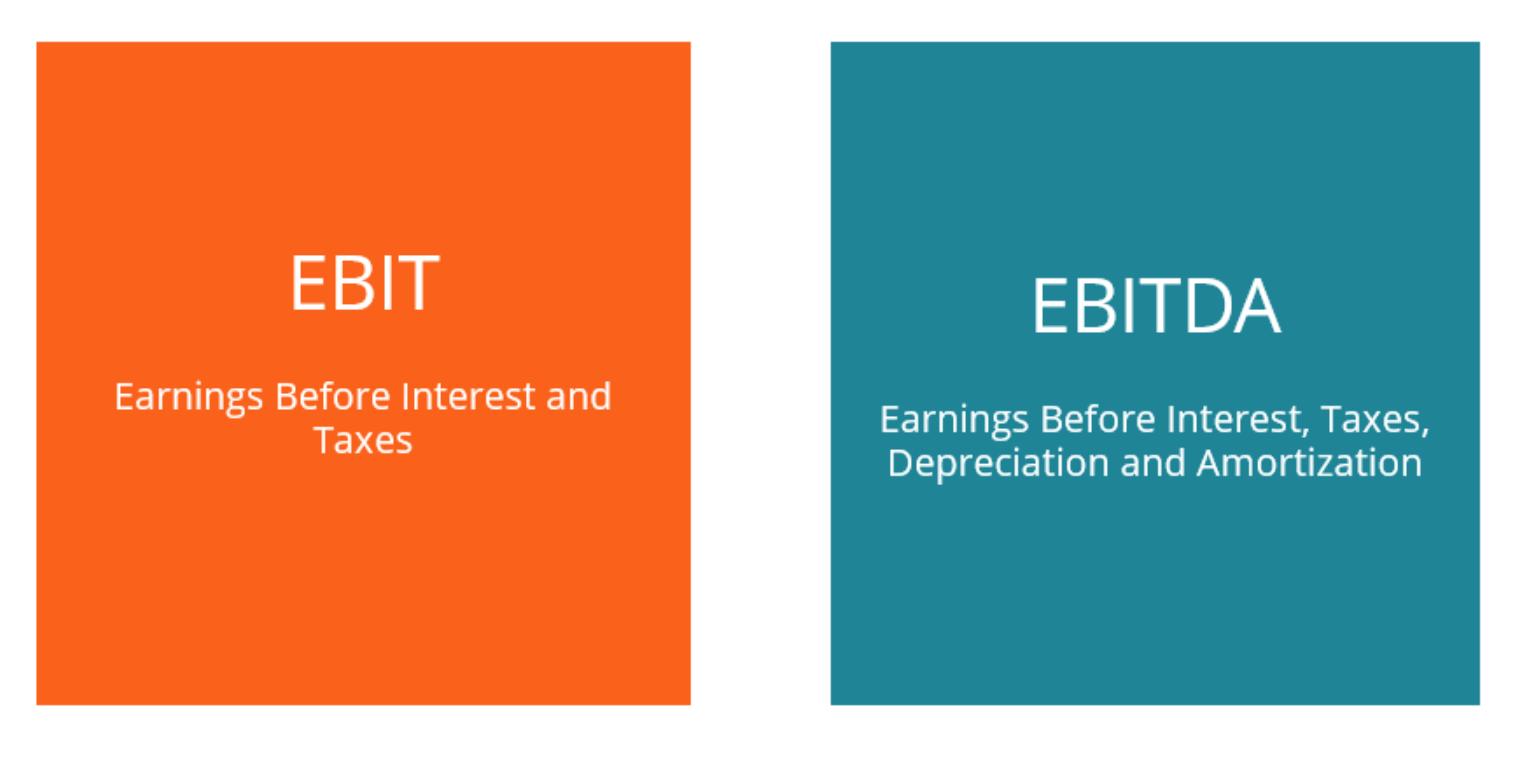

Determination of the value of the company being net assets plus goodwill. To calculate owners return multiple should be between 1-2 and to calculate EBIT multiple should be between 15-3 multiple 3 is used only if the business is really. Simple Average Profits.

Of years purchase The first step under this method is the. Goodwill Super Profit x. Calculate the future maintainable profit.

This is an income-valuation. This method is accomplished by finding the net present value NPV of expected future profits or cash flows and dividing them by the capitalization rate cap rate. The amount prevailing on 31st Dec.

Once you determine the profit you should use a right multiple ie. Adjusted current year profit or adjusted next year profit are common proxies for future maintainable earnings. Determination of the goodwill value by deducting the capitalised value less net tangible assets employed in the business.

Under this method the value of Goodwill is calculated by multiplying the Average Future profit by a certain number of years purchase. Average Profit before tax and Directors remuneration ie. Simple Average Profits can be calculated by dividing the sum of profits of the years by number of years.

The discounted future earnings method uses these forecasts for the earnings of a firm and the firms estimated terminal value at a future date. Profit Tax Directors Remuneration Directors remuneration has been considered as Rs. A short video describing the most common method of business valuation.

A calculation of past average taxed earnings. Detailed answer for question - Future Maintainable Profit how to calculate future maintainable profit for calculating goodwill. Future Maintainable Profit FMP Before calculating the goodwill one has to first calculate the FMP It is very complicated task.

If the companys recent performance is not assessed to be maintainable into the future then the valuer may take a longer term view and may also incorporate. The Future Maintainable Earnings Method. To use this method youll need to calculate the average profits from the previous years.

Futur maintainable profits means certainity in generation of profits. The valuation expressed as a formula is. 2008 and not the average since the same cannot be paid less than Rs.

Valuation of the total value of the business by applying the capitalisation rate to future maintainable earnings. A Calculation of past average earnings. So speculation profit and losses will not consider for FMP.

The steps necessary to arrive at the future maintainable profits of a company are. The valuer should always critically examine past performance and probable future events in relation to the business or entity being valued. Posted by Student CA FOR INDIAS BEST CA CS CMA VIDEO CLASSES CALL 9980100288 OR VISIT HERE.

The business value is derived by capitalising the maintainable earnings by an appropriate multiple which is reflective of the inherent risk the business may have. Maintainable earnings are calculated based on the historical profit of the business over a period of time commonly three years but exclude non-business and extraordinary items.

Business Valuation How To Calculate Your Company S Worth Accru

Business Valuation How To Calculate Your Company S Worth Accru

Earnings Yield Overview Formula And Practical Example

Earnings Yield Overview Formula And Practical Example

/dotdash_INV_final_Discounted_Future_Earnings_Jan_2021-01-06a946185067407e8eb75c909bed0a0e.jpg) Discounted Future Earnings Definition

Discounted Future Earnings Definition

2 Valuation Of Goodwill Average Profit Problem By Saheb Academy B Com Bba Cma Youtube

2 Valuation Of Goodwill Average Profit Problem By Saheb Academy B Com Bba Cma Youtube

Vlsi Projects Vlsi Projects Using Vhdl Vlsi Project Engineering Student Engineering Design Engineering

Vlsi Projects Vlsi Projects Using Vhdl Vlsi Project Engineering Student Engineering Design Engineering

2 Valuation Of Goodwill Average Profit Method Youtube

2 Valuation Of Goodwill Average Profit Method Youtube

Methods Of Valuation Of Goodwill Seven Different Methods With Solved Problem By Kauserwise Youtube

Methods Of Valuation Of Goodwill Seven Different Methods With Solved Problem By Kauserwise Youtube

Top 9 Business Valuation Methods Caplinked

Top 9 Business Valuation Methods Caplinked

/dotdash_INV_final_Discounted_Future_Earnings_Jan_2021-01-06a946185067407e8eb75c909bed0a0e.jpg) Discounted Future Earnings Definition

Discounted Future Earnings Definition

Ebit Vs Ebitda Pros Cons And Important Differences To Know

Ebit Vs Ebitda Pros Cons And Important Differences To Know

2 Valuation Of Goodwill Average Profit Method Youtube

2 Valuation Of Goodwill Average Profit Method Youtube

40 Calculation Of Capital Employed For Goodwill How To Calculate Capital Employed In Goodwill Youtube

40 Calculation Of Capital Employed For Goodwill How To Calculate Capital Employed In Goodwill Youtube

Consider Carefully The Weighted Average Approach In Projecting Future Earnings J Richard Claywell Cpa

Consider Carefully The Weighted Average Approach In Projecting Future Earnings J Richard Claywell Cpa

How To Calculate Business Maintainable Earnings Infographic

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discounted_Future_Earnings_Jan_2021-01-06a946185067407e8eb75c909bed0a0e.jpg) Discounted Future Earnings Definition

Discounted Future Earnings Definition

Specializing In Helping Individuals Significantly Increase Their Credit Score Begin Today And Qualify For The Home Of Credit Score Good Credit No Credit Loans

Specializing In Helping Individuals Significantly Increase Their Credit Score Begin Today And Qualify For The Home Of Credit Score Good Credit No Credit Loans

How To Calculate Fmp Capital Employed Youtube

How To Calculate Fmp Capital Employed Youtube

How To Calculate Future Maintainable Profit In Valuation Of Goodwill By Ca Gopal Somani Youtube

How To Calculate Future Maintainable Profit In Valuation Of Goodwill By Ca Gopal Somani Youtube