Schedule K-1 Form 1120s Codes 2020

Other information Code A. Has two distinct sections entitled Heading Information and Income Deductions Credits and Other Items.

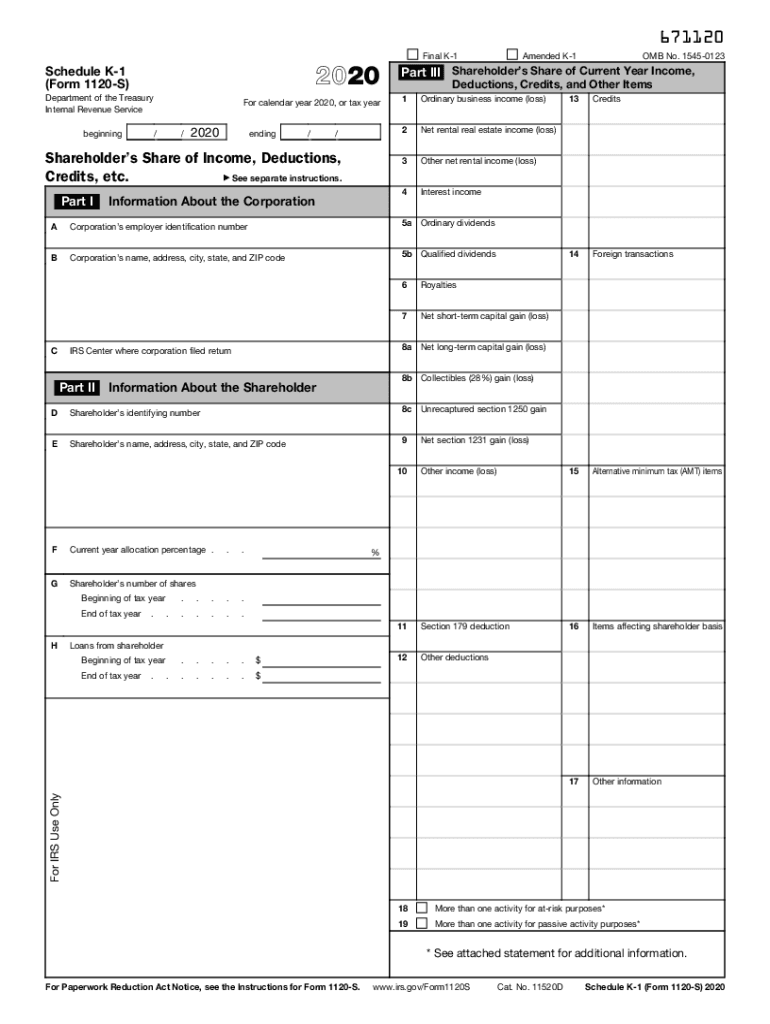

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

Whats New List of codes.

Schedule k-1 form 1120s codes 2020. The shareholders use the information on the K-1 to report the same thing on their separate tax returns. For detailed reporting and filing information see the specific line instructions earlier and the instructions for your income tax return. 2020 02102021 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits etc.

Schedule K-1 Form 1120-S 2020. Basis of energy property See page 16. Code G of Schedule K-1 Form 1120-S box 12 is now used to report certain cash contributions made in calendar year 2020 or 2021.

Instructions for Schedule K-1 Form 1120-S Print Version PDF. Code G of Schedule K-1 Form 1120-S box 12 is used to report certain cash contributions made in calendar year 2020 or 2021. Schedule K-1 for S corporations.

All Schedule K-1 Form 1120-S Revisions. 1 Ordinary business income loss A B Form 8582 line 1 or 3 to figure the amount to report on Sch E line 28 columns g or h C D Sch E line 28 column i or k. Department of the Treasury Internal Revenue Service For calendar year 2020 or tax year.

Ending Shareholders Share of Income Deductions Credits etc. 2020 11182020 Inst 1120-S Schedule K-1. A shareholder needs this information to help determine if they are required to file Form 8990 the gross receipts test.

About Publication 535 Business Expenses. The Box 17 information that is used in the QBID calculation is the following. 2020 12222020 Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains 2020 01122021 Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits etc.

In 2020 Form 1120-S Schedule K-1 line 17 code AC is now used to report the gross receipts amount for section 448 c. Other Items You May Find Useful. 2020 02042021 Form 8865 Schedule K-1 Partners Share of Income Deductions Credits etc.

To enter the Items Affecting Shareholders Basis from a K-1 Form 1120S in TaxSlayer Pro from the Main Menu of the Tax Return Form 1040 select. Rents Royalties Entities Sch E K-1 4835 8582 K-1 Input and select New and double-click on Form 1120S K-1 S Corporation which will take you to the K-1 Heading Information Entry Menu. After filing Form 1120S each shareholder is provided a Schedule K-1 by the corporation.

The S-Corporation reports this information on the Schedule K-1 Form 1120S in Box 17 Code V through Z. 2020 Schedule K-1 Form 1120-S 671120 2020 Schedule K-1 Form 1120-S Department of the Treasury Internal Revenue Service beginning Part III Shareholders Share of Current Year Income Deductions Credits and Other Items 1 Ordinary business income loss 2 Net rental real estate income loss 3 Other net rental income loss 4 Interest income 2020 ending Information About the. 2020 Form 1120-S Schedule K-1-- Line amount data flow in 1040 package -- Line.

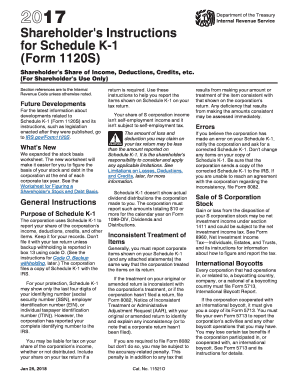

Shareholders Instructions for Schedule K-1 Form 1120-S 2020 Shareholders Share of Income Deductions Credits etc. If the initial K-1 entry was previously keyed in double. New employee retention credit.

Charitable Contributions under Specific Instructions for Schedules K and K-1. After entering all of the information required on the K-1 Heading Information screen select OK. Qualified rehabilitation expenditures other than rental real estate See page 16 Code E.

2020 11182020 Inst 1120-S Schedule K-1 Instructions for Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc. Schedule K-1 Codes Form 1120-S S Corporation List of Codes This list identifies the codes used on Schedule K-1 for all shareholders. The K-1 1120S Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 Form 1120S that the taxpayer received.

None at this time. Fuel tax credit information Form 4136 Code D. Investment expenses Form 4952 line 5 Code C.

For Shareholders Use Only Section references are to the Internal Revenue Code unless otherwise noted. Most loss deduction and credit items reported on the Schedule K-1 may require adjustment based on basis limitations at. If the corporation has investment income or other investment expense it will report the Taxpayers share of these items in Box 20 Codes A and B of the Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc.

Beginning 2020. The S corporation provides Schedule K-1s that reports each shareholders share of income losses deductions and credits. The draft instructions note that for tax years ending after 2019 individual taxpayers may elect to deduct certain cash contributions in amounts up to 100 of adjusted gross income.

The K-1 1120S Edit Screen. Other income loss Code A Other portfolio income loss. Investment income Form 4952 line 4a Code B.

Schedule K-1 Form 1120S is a source document that is prepared by a corporation as part of the filing of their tax return Form 1120S. It is this information from Box 17 of the Schedule K-1 Form 1120S that should be used by the Shareholder to calculate any 199A Deduction on their individual return. The K-1 reflects a shareholders share of income deductions credits and other items that the shareholder will need to report on their individual tax return Form 1040.

The Coronavirus Aid Relief and Economic Security Act CARES Act allows a new. Similar to a partnership S corporations must file an annual tax return on Form 1120S. Schedule K-1 Form 1120-S and its instructions such as legislation enacted after they were published go to IRSgovForm1120S.

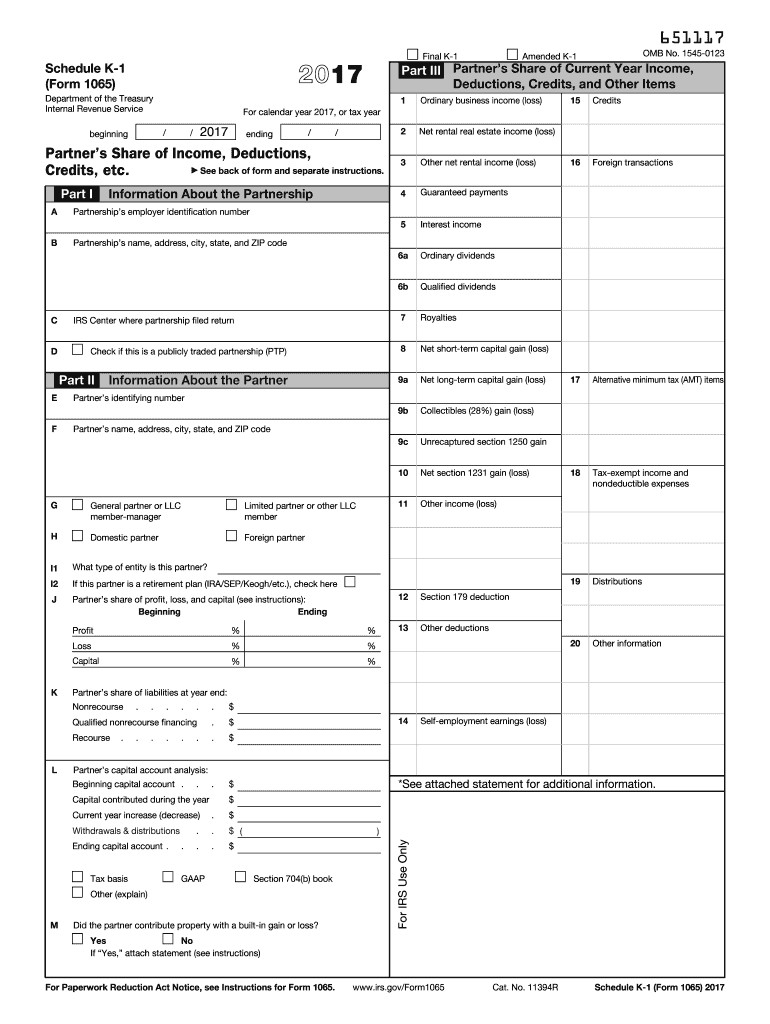

Instructions for Schedule K-1 Form 1065.

Irs Releases Drafts Of Revised Forms 1065 1120 S And K 1 Taxing Subjects

Irs Releases Drafts Of Revised Forms 1065 1120 S And K 1 Taxing Subjects

Fillable Online Schedule K 1 Form 1120s 2010 Page 2 This List Identifies The Codes Used On Schedule K 1 For All Shareholders And Provides Summarized Reporting Information For Shareholders Who File Form 1040

Fillable Online Schedule K 1 Form 1120s 2010 Page 2 This List Identifies The Codes Used On Schedule K 1 For All Shareholders And Provides Summarized Reporting Information For Shareholders Who File Form 1040

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Shareholder S Instructions For Schedule K 1 Form 1120s Stambaugh Ness

Shareholder S Instructions For Schedule K 1 Form 1120s Stambaugh Ness

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2017 Form Irs 1065 Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

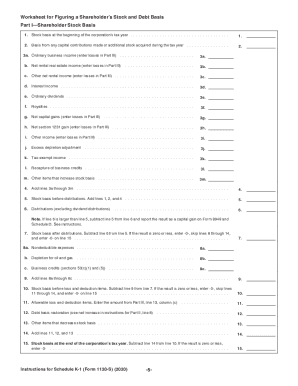

2020 Form Irs Instruction 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs Instruction 1120s Schedule K 1 Fill Online Printable Fillable Blank Pdffiller

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

1120s K 1 Codes Fill Online Printable Fillable Blank Pdffiller

1120s K 1 Codes Fill Online Printable Fillable Blank Pdffiller

S Corp Tax Return Irs Form 1120s White Coat Investor

S Corp Tax Return Irs Form 1120s White Coat Investor

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto