How Do I File My 1099 Nec Electronically

Enter all information correctly for the tax year then hit Next until youve to see Finish preparing 1099. E-File 1099 NEC Tax Form.

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

If you are submitting 24 or fewer Forms W-2 1099-MISC 1099-R or W-2G you are encouraged to file electronically but may file paper forms.

How do i file my 1099 nec electronically. Select Print on a 1096. Click Income then click Business income or loss. Businesses will use this form for payments for services as part of their trade or business.

Select the appropriate option from the drop down box. The 1099-Misc Form 2020 filing deadlines are based on the type of filing. In addition to individuals a business may file a 1099-NEC.

When Do I File a 1099-Misc Form with the IRS. Click the Ready To Transfer link above. You must register with the FIRE system by filing an online application.

On smaller devices click in the upper left-hand corner then click Federal. State-Specific Guidance for Form 1099-NEC Filing Form 1099-NEC with the states may be different than you are used to though. The Benefits of Filing Online.

Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. The 2021 deadlines for Form 1099-MISC are. Click Transfer to submit your file.

So lets get back to your 1099-NEC and outline what it reports and what you do with it. Locate your Form W-2 1099 or W-2G file on your PC or network. You can file both forms electronically or mail them to the IRS.

Send Copy B of 1099-Misc to the recipient by February 1st 2021. On the Select the File line click on the Browse button to locate the file on your PC or network. Nonemployee compensation 1099-NEC.

File your 1099-Misc Form to the IRS by March 1 2021 through paper forms. File or Enter Manually. IP 2021 12 Forms 1099-R 1099-MISC and W-2G Electronic Filing Requirements for Tax Year 2020.

If file electronically then the filer must file his form by March 31 2021. From within your TaxAct return Online or Desktop click Federal. E-Filing 1099 Forms With the IRS You can submit all 1099 forms including Form 1099-NEC to the IRS by mail or online using the Filing Information Returns Electronically FIRE system.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. The Employer W-21099 Menu allows you to enter or edit information that was filed manually or uploaded in e-TIDES. Click Add Schedule C.

We provide full-time customer service so you can call to our customer number 1 316 869-0948 if you. DRS no longer requires the filing of Form 1099-S or Form 1098. You can either file 1099-NEC electronically with the IRS using the IRS FIRE system or you can mail it to your local Department of the Treasury Internal Revenue Service Center.

How To E File 1099 NEC Form. In your own files. Choose Expenses from the left menu then select Vendors.

Refers to the blue TTax buttons shown in my IMAGE 1 in my previous reply ie Choose Online or Choose Desktop. You can file your W-2 wage records 1099-R distributions 1099-MISC1099-NEC income and REV-1667 Annual Withholding Reconciliation Statement Transmittal in e-TIDES using the File ReturnPayment link. For tax year 2020 or a prior year entities or people who have paid you money during the year but who are not your employer will mail you a 1099-MISC form for.

Pick the 1096 form then tap Yes looks good. E-File of 1099-NEC can only be accomplished via TTax by clicking Choose. The mailing address depends on your state.

Tap Print and mail. If you plan on e-Filing Form 1099-MISC or 1099-NEC use the IRSs FIRE System. If online only is confusing maybe TTax can clarify its button labels.

Specific Instructions for Form 1099. August 12 2019 1031. If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676.

Form 2290 Online Filing Irs Forms Filing Taxes Tax Forms

Form 2290 Online Filing Irs Forms Filing Taxes Tax Forms

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

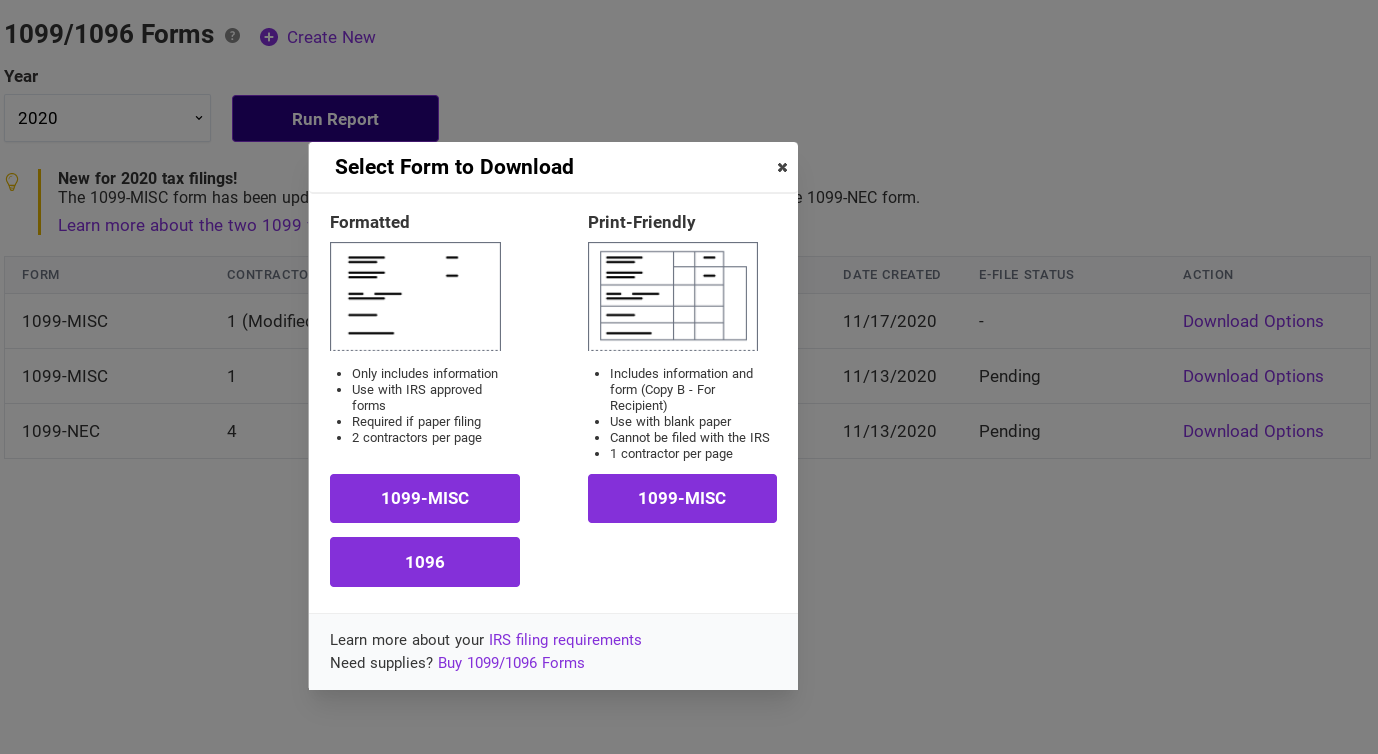

Electronically File 1099s Patriot Software

Electronically File 1099s Patriot Software

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Questions And Answers About Form 1099 Nec

Questions And Answers About Form 1099 Nec

How To File Form 1099 Nec Electronically Youtube

How To File Form 1099 Nec Electronically Youtube

5 Easy Steps To Efile Form 1099 Nec Online Through Taxseer In 2021 Efile Nec Filing Taxes

5 Easy Steps To Efile Form 1099 Nec Online Through Taxseer In 2021 Efile Nec Filing Taxes

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

Account Abilitys 1099 Oid User Interface Data Is Entered Onto Windows That Resemble The Actual Forms Imports Recipient Information From Irs Forms Irs Efile

Account Abilitys 1099 Oid User Interface Data Is Entered Onto Windows That Resemble The Actual Forms Imports Recipient Information From Irs Forms Irs Efile

How To Electronically File Irs Form 1099 Misc Youtube

How To Electronically File Irs Form 1099 Misc Youtube

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

Irs 1099 Int Form Irs Authorized Services In Kansas Us Irs Efile Irs Forms

Irs 1099 Int Form Irs Authorized Services In Kansas Us Irs Efile Irs Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

How Do I Include Irs 1099 Information Return Income On My Tax Return Tax Return Income Tax Return 1099 Tax Form

How Do I Include Irs 1099 Information Return Income On My Tax Return Tax Return Income Tax Return 1099 Tax Form

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms