Excess Business Interest Expense Form 1040

Excess business interest expense is applied to basis second. Instructions For Form 4952 - Investment Interest Expense Deduction.

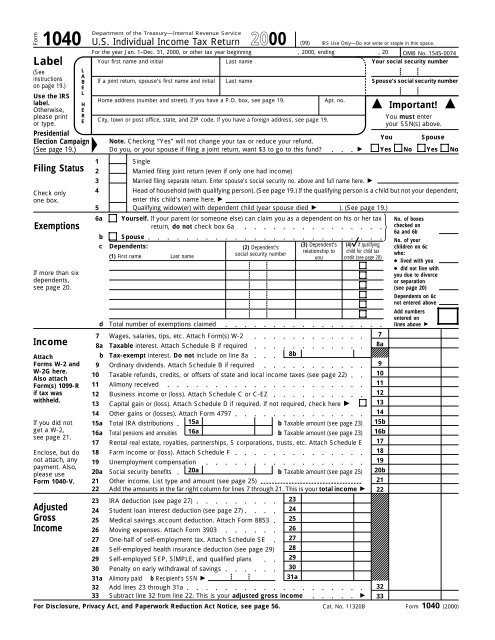

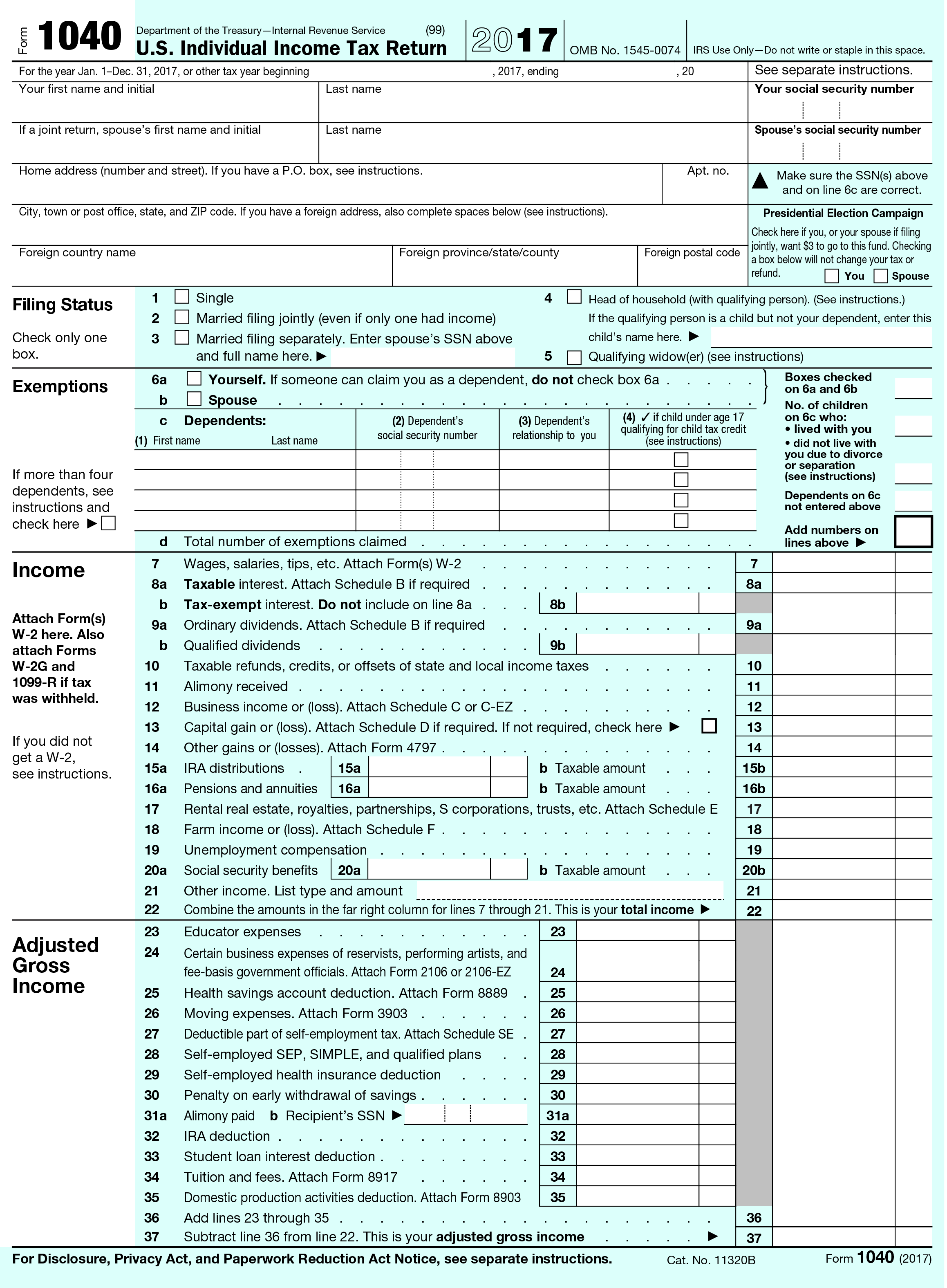

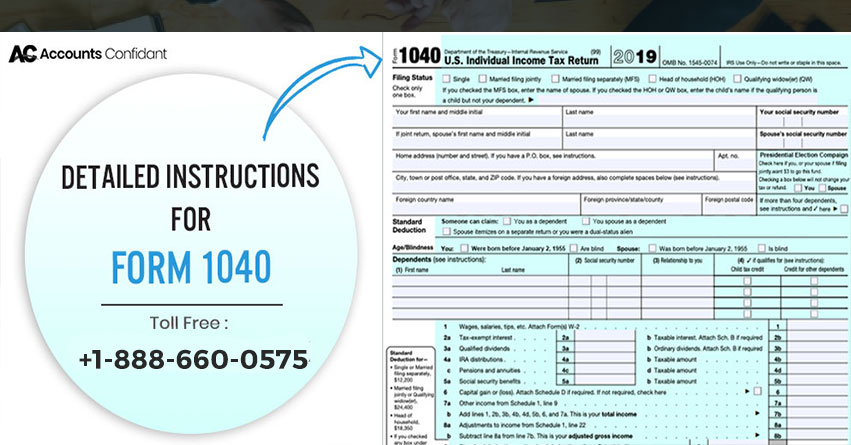

Form 1040 1040 Sr Everything You Need To Know

Form 1040 1040 Sr Everything You Need To Know

However in order to access Form 4952 in TaxSlayer Pro the taxpayer has to meet certain conditions.

Excess business interest expense form 1040. If there is no excess business interest expense in the return passed-through from another partnership marking the field will stop Form 8990 from printing. Or current year or prior year excess business interest expense generally must file Form 8990 unless an exclusion from filing applies. 30 of adjusted taxable income ATI for the year or zero if the taxpayers ATI is less than zero.

If your interest expense is small and doesnt exceed 30 of the taxable income there is no limitation. Generally your deduction for investment interest expense is limited to your net investment incomethat is the interest expense cannot be greater than the income generated from the investment. A taxpayer with business interest expense.

Excess business interest expense is only applicable to partnerships subject to section 163j. Jun 06 2019 Form 8990s utility for a Personal Form 1040 is probably close to zero if not zero. This amount will automatically flow to Form 4952 Form 1040 line 1.

On a separate line enter interest expense and the name of the partnership in column a and the amount in column h. A disallowed business interest expense carryforward. So my question is what form to take the deduction.

Film and television production expenses. If the proceeds were used in a trade or business activity report the interest on Schedule E Form 1040 line 28. In addition if a partnership has negative section 704d expense interest expense that is limited by basis negative section 704d expense becomes excess business interest expense in the year that the basis limitation no longer applies.

This article provides information about how to file Form 8990 in UltraTax CS1040. Penalty on early withdrawal of savings. You calculate this.

Aug 13 2019 Investment interest expenses. That is not where the deduction is taken. Jun 29 2020 Line 44 column h.

Business interest income 2. For individuals these adjustments were reported on the IA 1040 line 14 code u. For tax years beginning after 2017 the deduction for business interest expense cannot exceed the sum of the taxpayers.

30 of the adjusted taxable income and 3. But you may be able to carry over excess interest expenses to a future years taxes. The expense is a separately stated item on the K-1 and must be entered manually.

For example if your home office is 10 percent of your home you can deduct 10 percent of mortgage interest and other expenses. Floor plan financing interest expense. On line 43 enter the amount of current year excess business interest expense in column c current year excess taxable income in column f and the current year business interest income in column g reported to the partner on Schedule K-1 for each partnership.

Enter this total amount on Part I line 3. That form is used to compute the deductible amount of the excess. For the partners subject to the section 163j limitation add the amounts entered on line 43 column h for all partnerships listed.

Interest expense allocated to debt-financed distributions. Without further guidance Im going to report on Sch E page 2 along with the other K-1 pass thru income. Report this amount on Form 1040 line 30.

The specific question goes to the point that the Taxpayer has received a Schedule K-1 1065 from a PTPMLP with entries on the K-1 possibly including on Line 13. Form 8990 is prompted on a 1065 Partnership return by the answers to question 24 and an 1120S S Corp by the answers to question 10. A pass-through entity allocating excess taxable income or excess business interest income to its owners that is a.

If there is business interest expense passed-through from another partnership Form 8990 will calculate per the instructions and print. Total excess business interest expense treated as paid or accrued. If the partnership has investment income or other investment expenses it will report the taxpayers share of these items in Box 20 using.

If you materially participated in the activity report the interest on line 28 of Schedule E Form 1040. Does not own a pass-through entity with carryover excess business interest expense. For a personal 1040 return its prompted by your K-1 entries specifically Line 13 Code K Excess Business Interest Expense.

The manner in which you report such interest expense depends on your use of the distributed debt proceeds. Jun 02 2019 Where do I answer. Taxpayers whose business interest expense deduction was limited for federal purposes needed to make certain adjustments to claim the larger Iowa deduction for 2018.

If section 163j applies to you the business interest expense deduction allowed for the tax year is limited to the sum of. In column a enter the name of the corporation and interest expense. Form 8990 calculates the business interest expense deduction and carryover amountsThe form utilizes the section 163j limitation on business interest expenses in coordination with other limits.

Business interest income for the tax year.

Find Irs Form 1040 And Instructions Irs Forms Irs Tax Extension

Find Irs Form 1040 And Instructions Irs Forms Irs Tax Extension

Irs Form 1040 Form 1041 Instructions Defensetax

Irs Form 1040 Form 1041 Instructions Defensetax

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

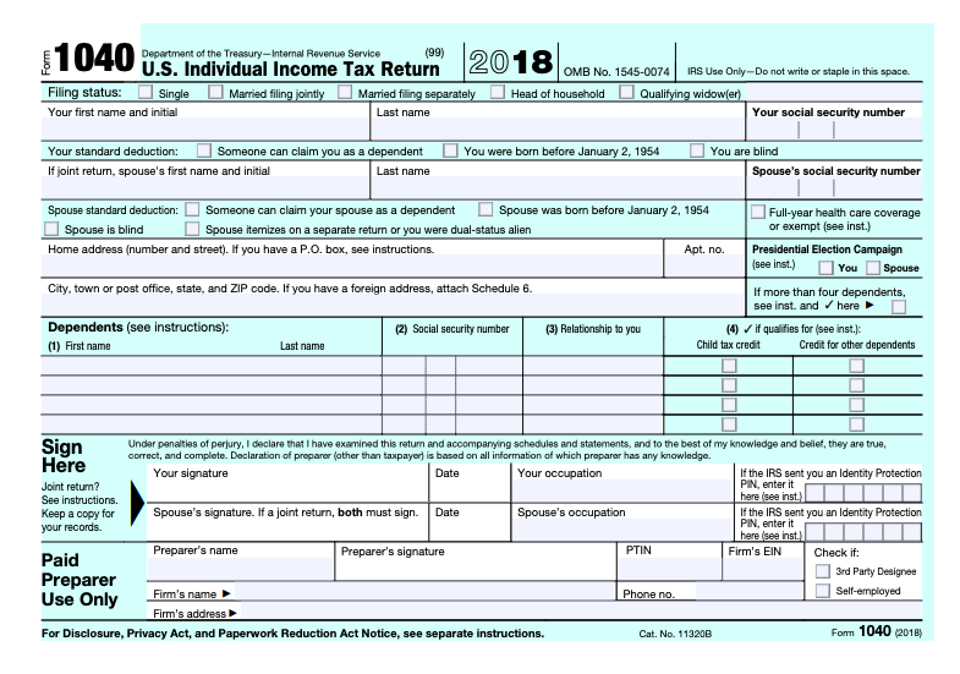

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules

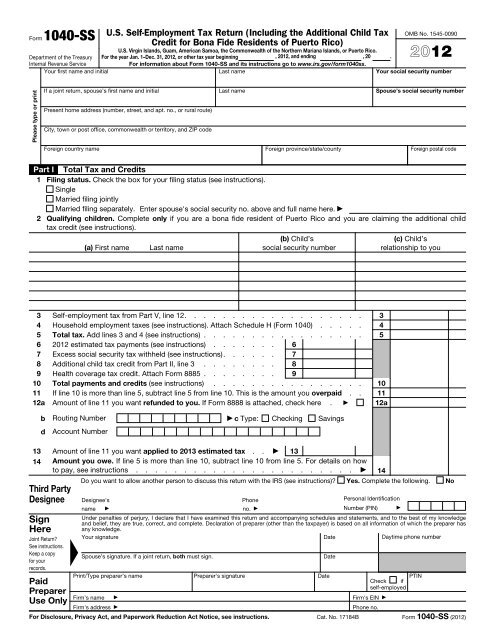

2012 Form 1040 Ss Internal Revenue Service

2012 Form 1040 Ss Internal Revenue Service

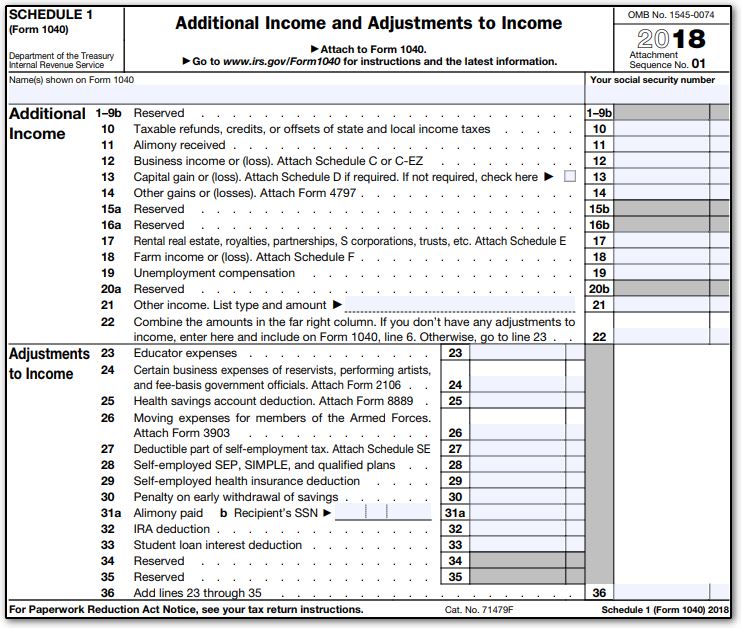

1040 Schedule 1 Drake18 And Drake19 Schedule1

1040 Schedule 1 Drake18 And Drake19 Schedule1

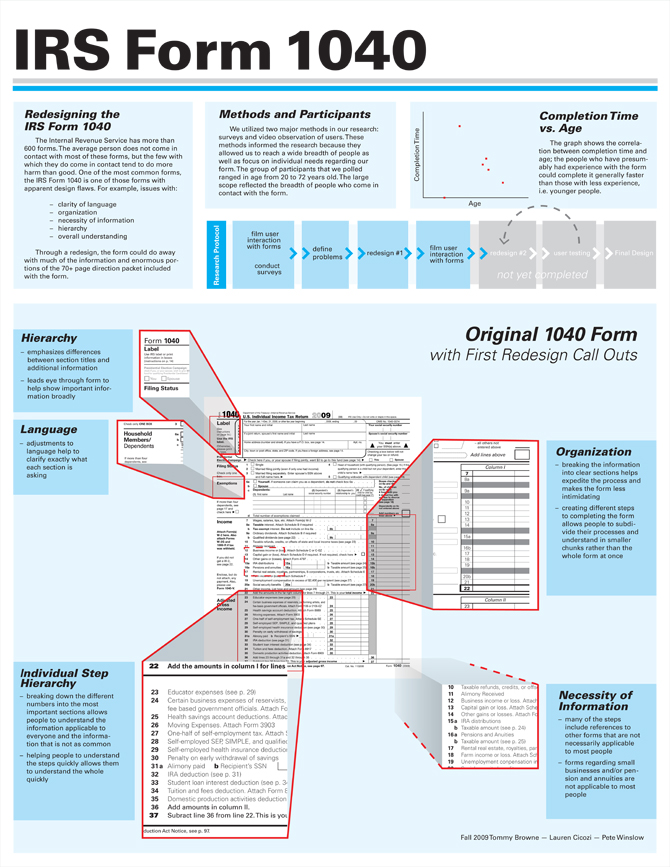

Form 1040 Gets A Makeover For 2018 Insights Blum

Form 1040 Gets A Makeover For 2018 Insights Blum

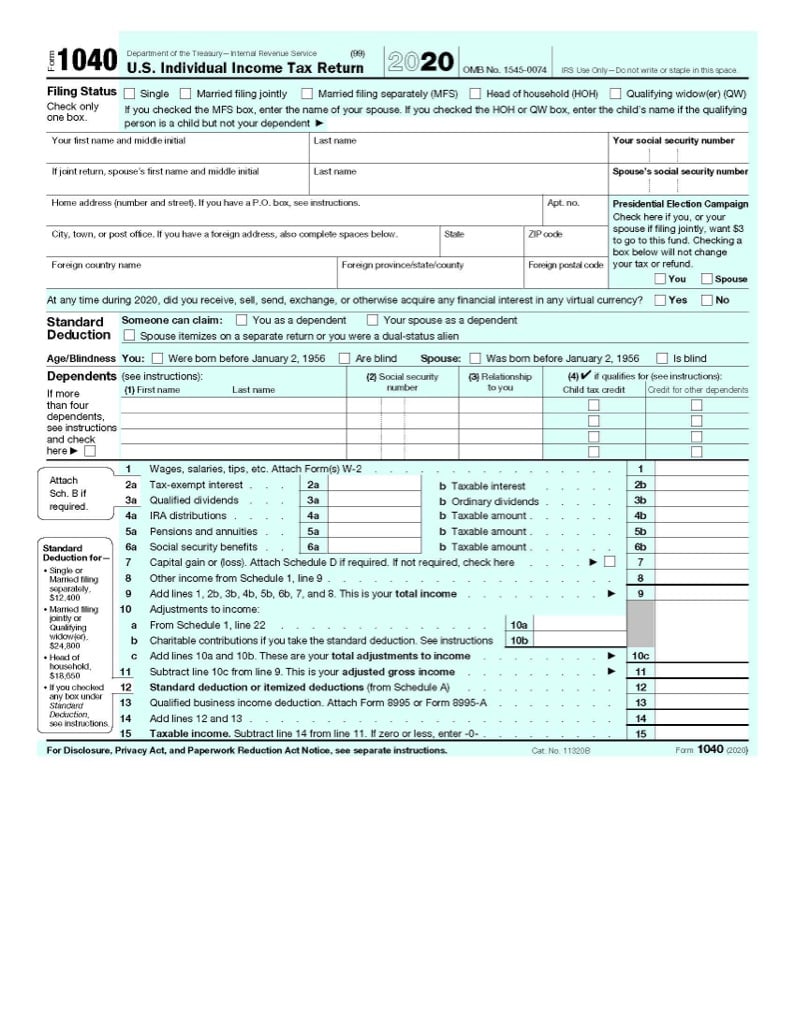

Form 1040 Internal Revenue Service

Form 1040 Internal Revenue Service

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

Top Facts About Irs Form 1040 Of Which You Might Not Be Aware Intelesoft Financials

Top Facts About Irs Form 1040 Of Which You Might Not Be Aware Intelesoft Financials

Form 14 Where To File 14 Things That Happen When You Are In Form 14 Where To File Outrageous Ideas Irs Forms Outrageous

Form 14 Where To File 14 Things That Happen When You Are In Form 14 Where To File Outrageous Ideas Irs Forms Outrageous

Tax Changes By Form Taxchanges Us

Tax Changes By Form Taxchanges Us

Irs Form 1040 How To File Instructions Tips Due Date Penalities

Irs Form 1040 How To File Instructions Tips Due Date Penalities

2018 Form 1040 Schedule 3 Wilson Rogers Company

2018 Form 1040 Schedule 3 Wilson Rogers Company

Irs Form 1040 Download Fillable Pdf Or Fill Online U S Individual Income Tax Return 2020 Templateroller

Irs Form 1040 Download Fillable Pdf Or Fill Online U S Individual Income Tax Return 2020 Templateroller

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service